Navigating the complexities of a volatile market requires a strategic approach to investment. Making smart investment decisions during periods of uncertainty can be challenging, but with careful planning and a thorough understanding of risk management, investors can protect their capital and potentially achieve significant returns. This article will guide you through key strategies for making sound investment choices in a fluctuating market, focusing on diversification, due diligence, and the importance of a long-term perspective to help you build a resilient investment portfolio.

Understanding Market Volatility

Market volatility refers to the rate and extent of changes in market prices. High volatility signifies rapid and substantial price swings, while low volatility indicates more stable and predictable price movements. These fluctuations are driven by a multitude of factors, including economic news, geopolitical events, investor sentiment, and company-specific announcements.

Understanding the sources of volatility is crucial for making informed investment decisions. Economic indicators such as inflation rates, interest rates, and employment data can significantly impact market performance. Geopolitical events, like wars or political instability, often introduce uncertainty and trigger market swings. Investor sentiment, driven by fear or greed, can lead to herd behavior and amplified price movements. Finally, company-specific news, such as earnings reports or product launches, can affect individual stock prices and contribute to overall market volatility.

Measuring volatility involves analyzing historical price data using metrics like standard deviation or beta. While predicting future volatility with certainty is impossible, understanding its underlying drivers allows investors to better assess risks and make more informed decisions about their investment strategies. Recognizing that periods of high volatility present both opportunities and risks is vital for success in the market.

Assessing Risk and Reward

In volatile markets, understanding the interplay between risk and reward is paramount for smart investment decisions. Risk refers to the potential for loss, while reward represents the potential for profit. A higher potential reward typically accompanies a higher level of risk.

Assessing risk involves evaluating factors such as market volatility, economic conditions, and the specific characteristics of the investment itself. This might include analyzing historical performance, understanding the company’s financial health (if investing in stocks), or examining the underlying assets (if investing in bonds or other instruments). Diversification across asset classes can help mitigate risk.

Assessing reward involves projecting potential returns based on various factors, including expected growth, dividend payments (if applicable), and the overall market outlook. Realistic expectations are crucial; avoid chasing high-reward, high-risk investments without a thorough understanding of the associated risk.

The key is finding a balance between risk and reward that aligns with your individual risk tolerance and investment goals. A well-defined investment strategy that clearly outlines your risk appetite and desired return is essential for navigating market volatility effectively.

Investment Diversification Strategies

Diversification is a cornerstone of smart investing, particularly in volatile markets. It involves spreading your investments across various asset classes to reduce risk. Instead of putting all your eggs in one basket, you lessen the impact of any single investment performing poorly.

Asset allocation is key to diversification. This strategy involves determining the proportion of your portfolio dedicated to different asset classes like stocks, bonds, real estate, and commodities. A balanced portfolio typically includes a mix of these, with the specific allocation depending on your risk tolerance and investment goals. Stocks offer higher potential returns but greater risk, while bonds provide stability but lower returns.

Geographic diversification extends this concept beyond asset classes. Investing in companies and assets from different countries helps mitigate risks associated with specific economies or political events. A downturn in one region might be offset by growth in another.

Sector diversification focuses on spreading investments across various industries. If one sector underperforms, others may offset the losses. For example, investing in both technology and healthcare can balance out potential risks.

Remember, diversification does not eliminate risk but significantly reduces its impact. A well-diversified portfolio requires careful consideration of your risk profile, investment horizon, and financial goals. Consulting a financial advisor can provide personalized guidance in building a robust and diversified investment strategy.

Using Technical and Fundamental Analysis

Navigating a volatile market requires a robust investment strategy. Technical analysis and fundamental analysis are two key approaches that, when used together, can significantly improve decision-making.

Technical analysis focuses on price charts and trading volume to identify trends and predict future price movements. It uses various indicators and patterns (like moving averages, RSI, and candlestick charts) to pinpoint potential entry and exit points. This approach is particularly useful for short-term trading strategies.

Fundamental analysis, conversely, delves into the intrinsic value of an asset. This involves examining a company’s financial statements, industry trends, management quality, and competitive landscape. The goal is to determine whether an asset is undervalued or overvalued relative to its underlying fundamentals. This is more suitable for long-term investment horizons.

By combining both approaches, investors gain a more holistic view. Technical analysis can help time entries and exits, while fundamental analysis provides the rationale for holding the asset long-term. For example, fundamental analysis might identify a fundamentally strong company, while technical analysis could indicate a favorable entry point based on chart patterns. This integrated approach significantly reduces risk and enhances the potential for successful investment decisions in unpredictable markets.

Long-term vs Short-term Investment Approaches

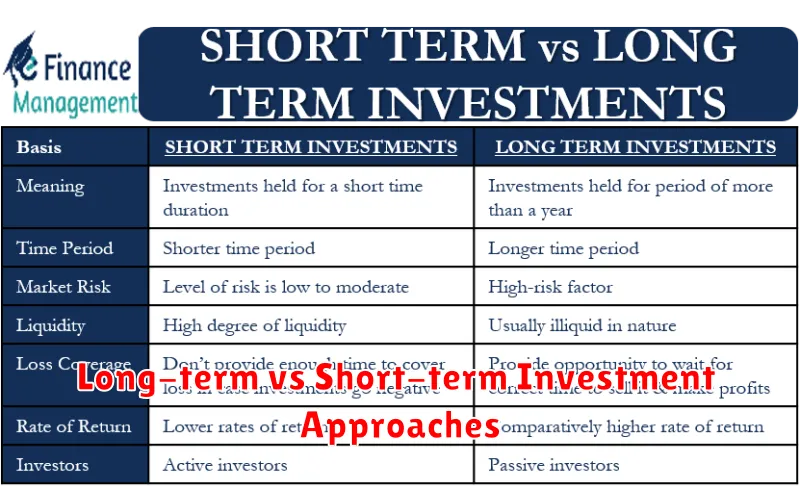

Navigating a volatile market requires a thoughtful approach to investing. A crucial element of this is deciding between long-term and short-term investment strategies. Each carries distinct risk and reward profiles.

Long-term investing, typically spanning several years or even decades, focuses on building wealth steadily over time. It involves holding investments, such as stocks or real estate, through market fluctuations, aiming to benefit from compound growth. This strategy is generally less volatile and better suited for those with a longer time horizon and higher risk tolerance.

Short-term investing, on the other hand, involves holding assets for a shorter period, often less than a year. This approach seeks to profit from short-term market movements and trends. While it potentially offers quicker returns, short-term investing is significantly riskier, requiring greater market expertise and a higher level of active management. Profits can be rapidly erased by sudden market shifts.

The optimal approach depends heavily on individual circumstances, including risk tolerance, financial goals, and time horizon. A balanced strategy, incorporating elements of both long-term and short-term investments, might be appropriate for some investors. However, understanding the inherent differences between these two approaches is paramount for making informed investment choices in uncertain market conditions.

How to Identify Market Trends

Identifying market trends is crucial for making smart investment decisions in a volatile market. Accurate trend analysis allows investors to anticipate market movements and adjust their portfolios accordingly.

One effective method is to analyze historical data. Examine past market performance, focusing on long-term patterns and cyclical fluctuations. This can reveal recurring trends and potential future scenarios.

Fundamental analysis involves assessing the underlying economic factors impacting the market. This includes studying economic indicators like inflation rates, interest rates, and GDP growth to predict market direction.

Technical analysis uses charting techniques and mathematical indicators to identify price patterns and momentum. Studying price movements and trading volume can help predict future price fluctuations.

News and events significantly influence market trends. Stay informed about geopolitical events, industry news, and regulatory changes, as these often cause significant market shifts.

Expert opinions, while not foolproof, can offer valuable insights. Consulting financial analysts and economists can provide a broader perspective on potential market trends.

Remember that no single method guarantees accurate predictions. A combination of these techniques, coupled with careful risk management, offers the best approach to navigating a volatile market and making informed investment decisions.

Avoiding Panic Selling During Downturns

Market downturns are inevitable. Panic selling, however, is a highly avoidable mistake that can significantly harm your long-term investment goals. Driven by fear and emotion, panic selling often leads to selling low and buying high – the opposite of what successful investors strive for.

To avoid this, maintain a long-term perspective. Remember your initial investment strategy and risk tolerance. A well-diversified portfolio, constructed with your financial goals in mind, should be able to weather market fluctuations. Regularly review your portfolio, but avoid making drastic changes based on short-term market volatility.

Dollar-cost averaging can help mitigate losses during downturns. Instead of investing a lump sum, spread your investments over time. This reduces your average cost per share and lessens the impact of market fluctuations. Furthermore, avoid checking your portfolio daily. Frequent monitoring can amplify anxiety and increase the likelihood of impulsive decisions.

Consider consulting a financial advisor. They can provide objective advice and help you stick to your investment plan, even during periods of market uncertainty. Remember, successful investing requires discipline and patience. By resisting the urge to panic sell, you significantly improve your chances of long-term success.

Expert Tips for Smart Investing

Diversification is key. Don’t put all your eggs in one basket. Spread your investments across different asset classes (stocks, bonds, real estate, etc.) to reduce risk.

Long-term perspective is crucial. Avoid making impulsive decisions based on short-term market fluctuations. Focus on your long-term financial goals.

Dollar-cost averaging helps mitigate risk. Invest a fixed amount of money at regular intervals, regardless of market conditions. This reduces the impact of volatility.

Invest in what you understand. Don’t chase hot tips or trendy investments. Stick to investments you understand and feel comfortable with.

Rebalance your portfolio periodically. Market fluctuations can shift your asset allocation over time. Rebalancing brings your portfolio back to its target allocation.

Seek professional advice if needed. A financial advisor can provide personalized guidance based on your individual circumstances and risk tolerance.

Stay informed, but don’t get overwhelmed by market noise. Regularly review your investments but avoid making frequent trades based on fleeting news.

Manage your emotions. Fear and greed can lead to poor investment decisions. Stick to your investment plan and avoid emotional reactions to market swings.

Control your expenses. Before investing, ensure you have a solid financial foundation. Pay down high-interest debt and build an emergency fund.

Consider tax implications. Different investment vehicles have different tax implications. Consult a tax professional to optimize your investment strategy.