Are you ready to take control of your financial future and achieve financial freedom? This comprehensive guide on smart investing will equip you with the strategies you need to grow your wealth. Learn how to navigate the complexities of the market, make informed investment decisions, and build a robust portfolio that aligns with your personal financial goals. Discover proven techniques for long-term wealth creation and unlock the secrets to achieving lasting financial security.

Understanding Investment Basics

Investing involves allocating capital with the expectation of generating future income or appreciation. It’s crucial to understand that all investments carry risk, meaning you could lose some or all of your invested money.

Diversification is a key principle, spreading investments across various asset classes (stocks, bonds, real estate, etc.) to reduce risk. Asset allocation refers to the proportion of your portfolio dedicated to each asset class, tailored to your risk tolerance and financial goals.

Risk tolerance represents your comfort level with potential investment losses. A higher risk tolerance generally allows for potentially higher returns but also greater potential losses. Conversely, a lower risk tolerance often leads to lower potential returns but also lower risk.

Return refers to the profit or loss generated from an investment, often expressed as a percentage. It’s important to remember that past returns don’t guarantee future performance.

Time horizon is a crucial factor. Longer time horizons generally allow for greater potential returns, as investments have more time to grow. Short-term investments typically carry less risk but offer potentially lower returns.

Before making any investment decisions, it’s essential to conduct thorough research and, if necessary, seek advice from a qualified financial advisor.

Types of Investment Opportunities

Stocks represent ownership in a company and offer potential for high returns but also carry significant risk. Bonds are debt instruments issued by corporations or governments, generally considered less risky than stocks but with lower potential returns.

Real estate involves investing in properties, either residential or commercial. This can provide rental income and potential appreciation in value, but requires significant capital and management.

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. They offer diversification and professional management but come with fees.

Exchange-Traded Funds (ETFs) are similar to mutual funds but trade on stock exchanges like individual stocks. They offer diversification and liquidity.

Commodities include raw materials such as gold, oil, and agricultural products. Investing in commodities can hedge against inflation but can be highly volatile.

Alternative investments encompass a broader range of assets, including private equity, hedge funds, and collectibles. These often require substantial capital and have varying levels of risk and liquidity.

Risk and Reward in Investing

Investing inherently involves a trade-off between risk and reward. Higher potential returns typically come with greater risk, while lower-risk investments generally offer more modest returns.

Risk encompasses the possibility of losing some or all of your invested capital. Factors contributing to risk include market volatility, economic downturns, and the specific characteristics of the investment itself (e.g., company-specific risk for stocks).

Reward, on the other hand, refers to the potential profit or return on your investment. This can take the form of capital appreciation (increase in value), dividends (for stocks), or interest payments (for bonds).

Understanding your risk tolerance is crucial. This involves assessing your comfort level with potential losses and aligning your investment strategy accordingly. Conservative investors might prefer lower-risk options like bonds or savings accounts, while aggressive investors may favor higher-risk investments such as stocks or alternative assets with the potential for higher returns.

Diversification is a key strategy to manage risk. By spreading investments across different asset classes, you reduce the impact of losses in any single investment. A well-diversified portfolio can help balance risk and reward to achieve your financial goals.

Building a Diversified Portfolio

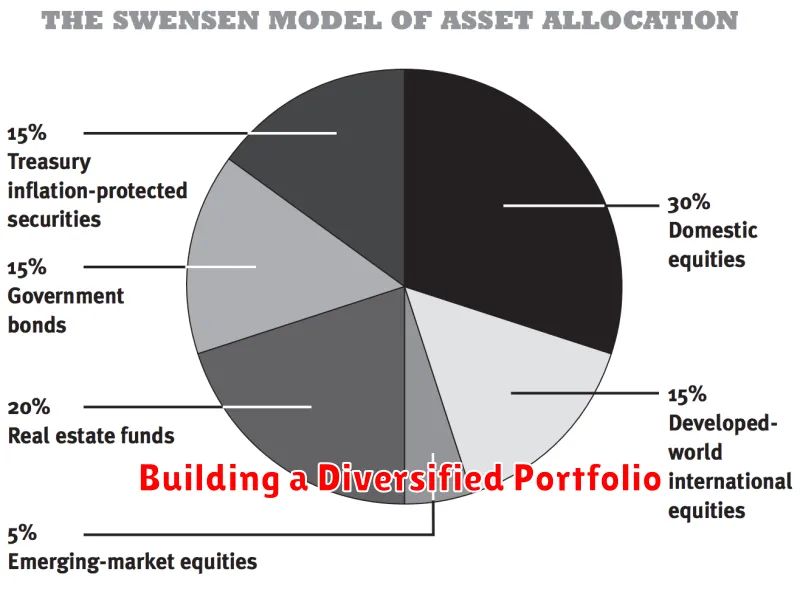

Building a diversified portfolio is a cornerstone of smart investing. It involves spreading your investments across different asset classes, reducing your overall risk. Instead of concentrating your wealth in a single area, diversification allows for potential gains in some areas to offset potential losses in others.

Asset allocation is key. This strategy involves determining the appropriate mix of assets like stocks, bonds, real estate, and commodities based on your risk tolerance, investment timeline, and financial goals. A younger investor with a longer time horizon might tolerate more risk and invest a larger portion in stocks, while an older investor closer to retirement might prefer a more conservative approach with a higher allocation to bonds.

Diversification within asset classes is also crucial. For example, within stocks, you can diversify across different sectors (technology, healthcare, energy, etc.), market capitalizations (large-cap, mid-cap, small-cap), and geographic regions. Similar diversification strategies apply to bonds and other asset classes.

While diversification doesn’t guarantee profits, it significantly mitigates the impact of market volatility. It’s a long-term strategy that requires patience and discipline. Regularly reviewing and rebalancing your portfolio to maintain your target asset allocation is essential to ensure your investment strategy remains aligned with your goals.

Analyzing Market Trends

Analyzing market trends is crucial for smart investing. It involves identifying patterns and shifts in market behavior to make informed investment decisions. This includes understanding the broader economic climate, industry-specific factors, and the performance of individual assets.

Several key tools and techniques facilitate trend analysis. Fundamental analysis examines a company’s financial health and future prospects, while technical analysis uses charts and historical data to predict future price movements. Quantitative analysis employs mathematical and statistical models to identify trends and relationships.

Understanding various economic indicators is vital. Inflation, interest rates, and GDP growth significantly influence market performance. Monitoring these metrics provides insights into potential opportunities and risks. Furthermore, staying abreast of geopolitical events and regulatory changes is essential, as these factors can have a profound impact on market trends.

Successful trend analysis necessitates a long-term perspective. Short-term market fluctuations can be misleading, and focusing on long-term growth trends is more likely to yield profitable results. Diversification of investment portfolios further mitigates risks associated with unpredictable market movements.

Long-term vs Short-term Investments

Understanding the difference between long-term and short-term investments is crucial for successful wealth building. Long-term investments, typically held for several years or even decades, aim for capital appreciation and often involve higher risk for potentially greater returns. Examples include stocks, real estate, and bonds with longer maturities.

Short-term investments, on the other hand, are held for a shorter period, usually less than a year. They prioritize liquidity and capital preservation, offering lower risk and typically lower returns. Examples include money market accounts, certificates of deposit (CDs), and short-term government bonds.

Your investment strategy should align with your financial goals and risk tolerance. Long-term strategies are generally suitable for achieving long-term objectives such as retirement or purchasing a home, while short-term investments can serve as a safety net for emergencies or near-future expenses. A balanced portfolio often includes a mix of both, providing a balance between growth potential and risk mitigation.

Investment Mistakes to Avoid

Ignoring diversification is a major pitfall. Don’t put all your eggs in one basket; spread your investments across different asset classes to mitigate risk.

Emotional investing, driven by fear or greed, leads to poor decisions. Stick to your investment plan and avoid impulsive buying or selling based on short-term market fluctuations.

Lack of research is another common mistake. Thoroughly research any investment before committing your funds. Understand the risks involved and the potential for return.

Failing to set financial goals leaves you without a clear direction. Define your investment objectives – retirement, education, etc. – to guide your strategy.

Ignoring fees and expenses can significantly eat into your returns. Choose low-cost investment options to maximize your profits.

Trying to time the market is notoriously difficult and often unsuccessful. Instead of trying to predict market peaks and troughs, focus on long-term growth.

Not rebalancing your portfolio regularly can lead to an imbalance in asset allocation. Periodically adjust your portfolio to maintain your desired risk level and asset mix.

Investing without a plan is a recipe for disaster. Create a well-defined investment plan that aligns with your goals, risk tolerance, and time horizon.

Chasing hot tips can lead to significant losses. Base your investment decisions on sound research and analysis, not on hearsay or speculation.

Ignoring taxes can substantially reduce your returns. Develop a tax-efficient investment strategy to minimize your tax liability.

Using Technology for Smarter Investing

Technology offers powerful tools for enhancing investment strategies. Online brokerage accounts provide easy access to a wide range of investment options, facilitating diversification and streamlined portfolio management.

Financial planning software and robo-advisors leverage algorithms to create personalized investment plans based on individual risk tolerance and financial goals. These tools can automate rebalancing, minimizing emotional decision-making often detrimental to long-term growth.

Investment research platforms provide access to real-time market data, company financials, and analyst ratings, enabling informed decisions. Mobile apps offer convenient portfolio tracking and alerts, keeping investors updated on market fluctuations and potential opportunities.

However, it’s crucial to remember that technology is a tool, not a guarantee of success. Thorough due diligence and a clear understanding of investment principles remain essential for achieving financial goals. While technology simplifies many aspects of investing, it cannot replace sound financial judgment and risk management.