Building wealth requires a strategic approach, and diversifying your income streams is a cornerstone of financial success. This article explores the powerful concept of passive income, detailing how to generate consistent wealth through various passive income streams. Discover proven strategies to build a robust financial foundation, enabling you to achieve financial freedom and long-term financial security with minimal ongoing effort. Learn how to create a sustainable flow of income that works for you, even while you sleep, ultimately accelerating your journey towards significant wealth accumulation.

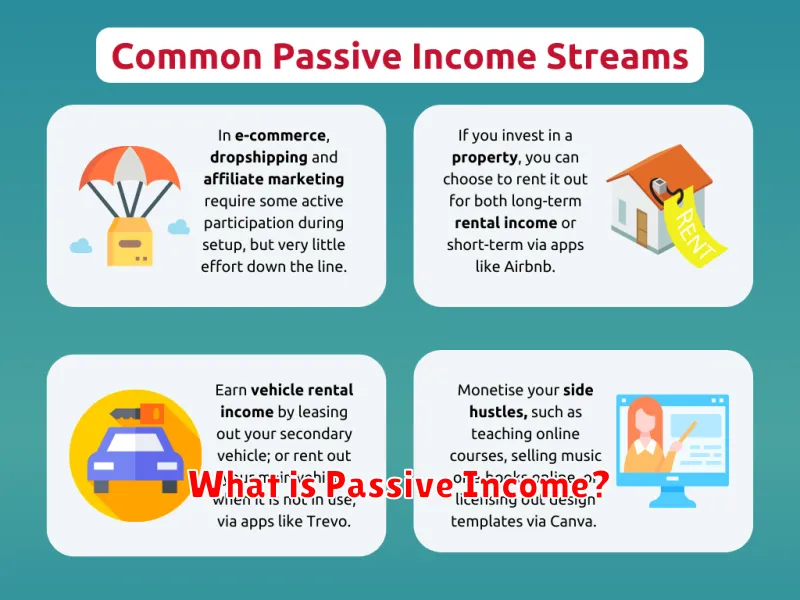

What is Passive Income?

Passive income is income earned with minimal ongoing effort required to maintain it. Unlike active income, which requires consistent work for continued earnings (e.g., salary), passive income streams generate revenue even while you’re not actively working on them.

It’s important to note that while the term “passive” suggests complete inactivity, most passive income streams require some initial setup and occasional maintenance. The key distinction lies in the scale of effort involved; once established, they require significantly less time and energy to manage than active income sources.

Examples of passive income include rental income from real estate, royalties from books or music, dividends from stocks, and income from affiliate marketing. The level of effort involved in managing each of these can vary considerably, but they all share the core characteristic of generating income with reduced ongoing effort.

Best Passive Income Ideas

Generating passive income is a crucial step in building long-term wealth. Several avenues offer significant potential, depending on your skills and resources. Consider these best passive income ideas:

High-demand digital products, such as online courses, ebooks, or templates, require upfront effort but generate consistent income with minimal ongoing maintenance. Affiliate marketing involves promoting other companies’ products and earning a commission on sales. This requires marketing savvy but can be highly lucrative.

Investing in dividend-paying stocks provides a passive income stream through regular dividend payouts. Real estate investment, particularly through rental properties, can offer substantial returns, though it demands significant upfront capital and ongoing management.

Creating and licensing intellectual property, such as music or artwork, allows for ongoing royalties from its usage. Peer-to-peer lending involves lending money to individuals or businesses and earning interest. This option carries risk but potential high returns.

The ideal passive income strategy depends on individual circumstances and risk tolerance. Careful research and planning are crucial for success in any chosen path.

Real Estate Investment for Passive Income

Real estate offers a powerful avenue for building passive income. Investing in rental properties, for instance, generates a consistent cash flow from monthly rents, even while requiring minimal active management.

Strategies include purchasing single-family homes, multi-family units, or even commercial properties. The level of involvement depends on your chosen approach; some investors actively manage their properties, while others utilize property management companies for hands-off operation.

Potential benefits extend beyond rental income. Real estate appreciates in value over time, providing capital gains when sold. Furthermore, mortgage payments can offer tax advantages, further enhancing your returns.

However, risks are inherent. Vacancies, repairs, and tenant issues can impact profitability. Thorough due diligence, including property inspections and market research, is crucial to mitigate these risks and ensure a successful passive income stream.

Ultimately, real estate investment requires careful planning and understanding of the market. Successful investors balance risk management with smart investment strategies to generate a substantial and sustainable passive income stream.

Dividend Stocks and Investments

Dividend stocks offer a compelling pathway to building wealth through passive income. By investing in companies that regularly distribute a portion of their profits to shareholders, you generate a steady stream of income alongside potential capital appreciation.

Selecting dividend stocks requires careful consideration. Look for companies with a history of consistent dividend payments, strong financial performance, and sustainable business models. Analyzing factors like dividend yield, payout ratio, and the company’s overall financial health is crucial.

Diversification is key to mitigating risk. Don’t put all your eggs in one basket; spread your investments across various sectors and companies to reduce the impact of any single stock’s underperformance. A well-diversified portfolio can provide more stability and potentially higher overall returns.

Reinvesting dividends can significantly accelerate wealth building. By reinvesting your dividend payments back into more shares, you benefit from the power of compounding, allowing your investments to grow exponentially over time. This strategy maximizes your returns and builds a larger, more substantial passive income stream.

Long-term perspective is essential when investing in dividend stocks. While short-term market fluctuations are inevitable, focusing on the long-term growth potential of your chosen companies will help you weather market downturns and maximize your returns over time. Remember that dividend payments are not guaranteed and can be reduced or eliminated by companies under certain circumstances.

Affiliate Marketing and Online Businesses

Affiliate marketing is a powerful method for building wealth through passive income streams. It involves promoting other companies’ products or services and earning a commission on each sale made through your unique affiliate link. This can be integrated effectively with various online businesses.

Establishing an online business, such as a blog, e-commerce store, or social media presence, provides a platform to promote affiliate products. The key is to choose products relevant to your audience and create engaging content that drives traffic and conversions. This allows you to generate passive income, meaning you earn money even while you sleep, making it a highly desirable aspect of wealth building.

Successful affiliate marketing requires careful selection of products or services, effective marketing strategies, and consistent effort in building your online presence and audience. However, with dedicated work and a well-structured approach, it can generate significant passive income streams, contributing substantially to long-term wealth accumulation.

Different online business models, like dropshipping or creating and selling online courses, can be enhanced by incorporating affiliate marketing. This creates a synergistic effect, boosting your overall income potential.

While it’s important to remember that building wealth takes time and consistent effort, affiliate marketing offers a significant opportunity to generate passive income and contributes to the overall goal of financial independence.

Automating Income Streams

Automating income streams is crucial for building significant passive wealth. It involves setting up systems and processes that generate income with minimal ongoing effort from you. This contrasts sharply with active income, which requires your constant time and attention.

Automation can take many forms. For example, you might automate the sale of digital products through an e-commerce platform, manage rental properties remotely using property management software, or leverage affiliate marketing with automated email sequences. The key is to create a system that runs efficiently without your direct intervention.

Effective automation requires upfront investment in time and resources. This may involve developing a detailed sales funnel, creating high-quality content, or investing in appropriate software and tools. However, this initial effort is often rewarded with a significant return, producing consistent income with reduced workload.

Monitoring and maintenance are still necessary, even with automated systems. Regular checks are crucial to identify and address any issues that might arise, ensuring the continued smooth operation of your income streams and preventing revenue loss.

Ultimately, automating your income streams is a strategic move towards financial freedom. By minimizing the need for active participation, you free up time and energy to pursue other goals, while simultaneously building a resilient and sustainable source of passive income.

Tax Considerations for Passive Income

Passive income, while attractive for wealth building, comes with its own set of tax implications. Understanding these is crucial for maximizing your returns.

Tax rates vary depending on the source of your passive income and your overall income level. For example, rental income is taxed differently than royalties from a book or profits from a limited partnership. It’s essential to accurately categorize your income streams for correct tax reporting.

Record-keeping is paramount. Meticulously track all income and expenses related to each passive income stream. This documentation is vital during tax season and protects you from potential audits.

Deductions can significantly reduce your tax liability. Expenses directly related to generating passive income, such as property taxes for rental properties or marketing costs for an online course, are often deductible. Consult a tax professional to ensure you claim all eligible deductions.

Tax-advantaged accounts, like Roth IRAs or 401(k)s, may offer opportunities to reduce your tax burden on both your active and passive income. Careful planning can leverage these accounts to minimize your overall tax liability.

Self-employment taxes apply to many forms of passive income. Unlike traditional employment where taxes are withheld, you’ll likely need to pay estimated quarterly taxes to cover both income tax and self-employment tax (Social Security and Medicare).

Seeking professional advice is strongly recommended. A tax advisor can provide personalized guidance based on your specific situation, ensuring you navigate the complexities of passive income taxation effectively and legally.

Common Mistakes to Avoid

One common mistake is underestimating the time investment required to set up and maintain passive income streams. While the *income* is passive, the *work* to establish and optimize it often isn’t.

Another frequent error is over-diversification. Focusing on too many different income streams can dilute your efforts and prevent you from achieving significant returns in any single area. Prioritize a few promising avenues.

Ignoring market research and due diligence is also a critical mistake. Thoroughly investigate any opportunity before investing significant time or money. Analyze market trends and competition to assess its viability.

Many individuals fall prey to get-rich-quick schemes promising effortless wealth. These are often scams designed to exploit those seeking passive income. Legitimate passive income requires effort and patience.

Finally, failing to reinvent and adapt is a significant pitfall. Markets and technologies change. Continuously evaluate your income streams and make adjustments to optimize performance and counteract emerging threats.