Understanding inflation and its impact on your finances is crucial in today’s economic climate. This article will explore the complexities of inflation, explaining what it is, how it’s measured, and most importantly, how it directly affects your personal finances, including your savings, investments, and purchasing power. We’ll delve into strategies for mitigating the effects of inflation and protecting your financial well-being during periods of rising prices.

What is Inflation?

Inflation is a general increase in the prices of goods and services in an economy over a period of time. When the price level rises, each unit of currency buys fewer goods and services. Consequently, inflation reflects a reduction in the purchasing power per unit of money – a loss of real value in the medium of exchange and unit of account within the economy.

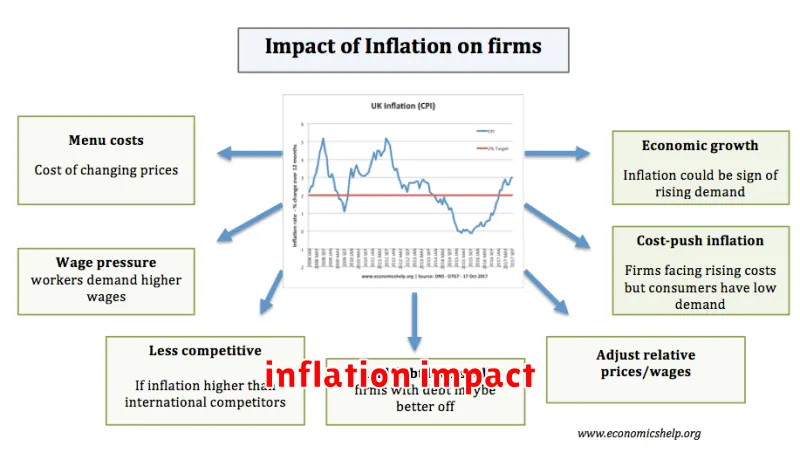

Several factors contribute to inflation, including increased demand for goods and services, rising production costs (like wages and raw materials), and an increase in the money supply. Different types of inflation exist, such as demand-pull inflation (caused by excess demand) and cost-push inflation (caused by rising production costs). Measuring inflation typically involves tracking the price changes of a basket of goods and services, often represented by a consumer price index (CPI).

Understanding inflation is crucial because it directly impacts your financial well-being. Rising prices erode the value of savings and reduce the purchasing power of your income. It’s important to consider inflation when making financial decisions, such as budgeting, investing, and saving for retirement.

Causes of Inflation

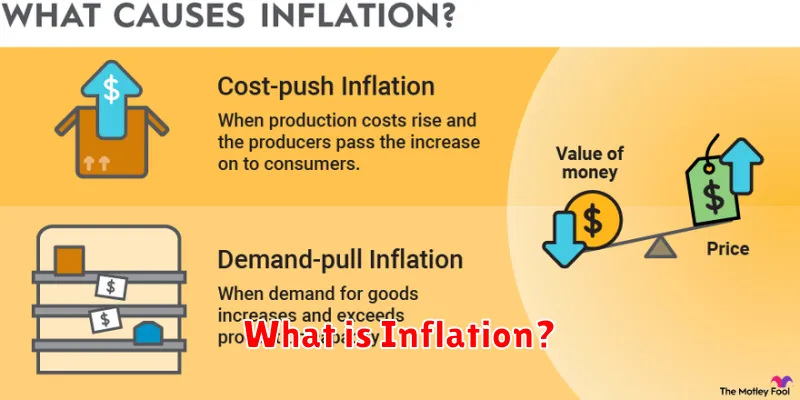

Inflation, a general increase in the prices of goods and services in an economy, stems from several key factors. Demand-pull inflation occurs when aggregate demand outpaces aggregate supply, leading to upward pressure on prices. Increased consumer spending, government spending, or investment can all contribute to this.

Cost-push inflation arises from increased production costs. This can be driven by factors such as rising wages, increased raw material prices (e.g., oil), or supply chain disruptions. These higher costs are then passed on to consumers in the form of higher prices.

Built-in inflation, also known as wage-price spiral, is a self-perpetuating cycle. As prices rise, workers demand higher wages to maintain their purchasing power. These higher wages, in turn, increase production costs, leading to further price increases. This creates a feedback loop.

Monetary inflation results from an increase in the money supply that outpaces economic growth. If the amount of money in circulation increases faster than the production of goods and services, each unit of currency becomes less valuable, leading to higher prices. Government policies related to money supply play a crucial role here.

Expected inflation occurs when individuals and businesses anticipate future price increases. This expectation can lead to them increasing prices and wages preemptively, further fueling inflationary pressures. It is important to note that these causes often interact and influence one another in complex ways.

How Inflation Affects Savings

Inflation erodes the purchasing power of your savings. When prices rise, the same amount of money buys fewer goods and services. This means that the real value of your savings decreases over time, even if the nominal amount remains the same.

For example, if you have $1,000 in savings and inflation is 5%, your money will only be able to purchase the equivalent of $950 worth of goods and services the following year. This loss of purchasing power is particularly significant for long-term savings goals like retirement, where the effects of inflation can compound over many years.

The impact of inflation on savings depends on the rate of inflation and the return on your savings. If your savings earn interest at a rate lower than the inflation rate, your savings are losing real value. To mitigate the effects of inflation, consider investing in assets that historically outpace inflation, such as stocks or real estate, or exploring savings accounts that offer higher interest rates.

Understanding how inflation impacts your savings is crucial for effective financial planning. By considering inflation’s effect, you can make informed decisions about saving and investing to protect your financial future.

Investment Strategies During Inflation

Inflation erodes the purchasing power of money, making investment strategies crucial during inflationary periods. The goal is to outpace inflation and preserve your wealth.

Inflation-protected securities (TIPS) are government bonds whose principal adjusts with inflation, offering a hedge against rising prices. Real estate can also be a good investment, as property values often increase alongside inflation.

Equities, particularly those of companies with strong pricing power, can be a suitable investment. These companies can pass increased costs onto consumers, protecting their profit margins. Commodities, such as gold and oil, are often seen as inflation hedges, as their prices tend to rise during inflationary periods.

Diversification is key. Spreading investments across different asset classes reduces overall risk. Short-term investments provide liquidity and can help you navigate uncertainty.

Regularly rebalancing your portfolio is essential to maintain your desired asset allocation and mitigate risk. Professional financial advice can be beneficial in navigating complex inflation-related investment decisions.

Government Policies on Inflation

Governments employ various policies to manage inflation, primarily focusing on monetary and fiscal strategies. Monetary policy, controlled by central banks, involves adjusting interest rates and the money supply. Raising interest rates makes borrowing more expensive, thus reducing spending and cooling down inflation. Conversely, lowering interest rates stimulates borrowing and economic activity.

Fiscal policy, managed by the government, involves adjusting government spending and taxation. Reducing government spending or increasing taxes can decrease the amount of money circulating in the economy, curbing inflation. Conversely, increasing government spending or decreasing taxes can stimulate economic growth, potentially leading to inflation.

The effectiveness of these policies depends on various factors, including the cause of inflation (demand-pull or cost-push), the state of the economy, and the timing and implementation of the policies. Finding the right balance is crucial; overly aggressive policies can lead to recession, while ineffective policies can allow inflation to spiral out of control.

The Role of Interest Rates in Inflation

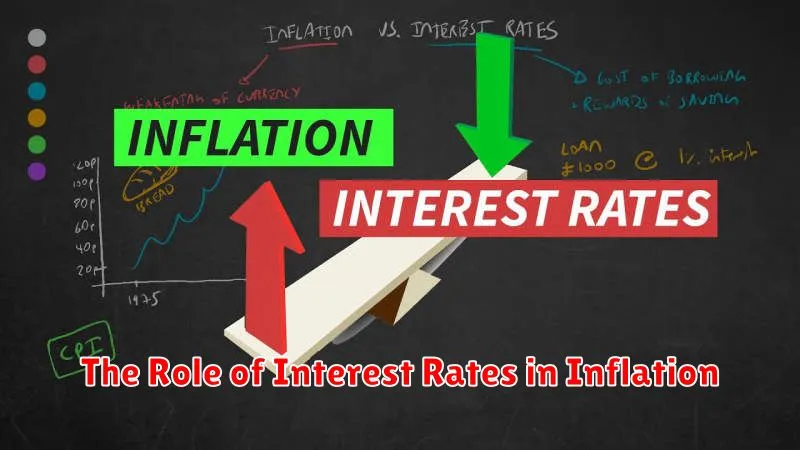

Interest rates are a crucial tool used by central banks to manage inflation. They influence borrowing costs for individuals and businesses.

When inflation is high, central banks typically raise interest rates. This makes borrowing more expensive, reducing consumer spending and business investment. Lower demand helps to cool down the economy and curb price increases.

Conversely, when inflation is low or the economy is weak, central banks may lower interest rates. This makes borrowing cheaper, encouraging spending and investment, stimulating economic growth.

The relationship, however, isn’t always straightforward. Other factors, such as supply chain disruptions or global economic events, can also significantly impact inflation. The effectiveness of interest rate adjustments depends on various economic conditions and can have a delayed effect on inflation.

Understanding the role of interest rates is key to comprehending how central banks attempt to maintain price stability and control inflation. The impact on individuals includes changes in borrowing costs for mortgages, loans, and credit cards, as well as returns on savings accounts.

Inflation-Proof Assets

Inflation erodes the purchasing power of money over time. To protect your finances, investing in inflation-proof assets is crucial. These assets tend to hold or increase their value even when inflation rises.

Real estate is often considered an inflation hedge. As inflation increases, so do property values and rental income, often outpacing the inflation rate. However, real estate investments require significant capital and carry inherent risks.

Commodities like gold and precious metals are another popular choice. Historically, they have served as a store of value during inflationary periods. Their prices often rise with inflation, acting as a safeguard against its effects. However, commodity prices can be volatile.

Treasury Inflation-Protected Securities (TIPS) are government bonds that adjust their principal value based on inflation. This ensures your investment keeps pace with rising prices, offering a relatively safe inflation-protected return.

Stocks, particularly those of companies with strong pricing power, can also offer some inflation protection. Companies able to pass increased costs onto consumers maintain profitability even during periods of high inflation.

Diversification across different inflation-proof assets is recommended to mitigate risk. The optimal strategy will depend on your individual risk tolerance, investment timeline, and financial goals. It’s advisable to consult a financial advisor for personalized guidance.

How to Prepare Financially for Inflation

Inflation erodes the purchasing power of money. To protect your finances, a multi-pronged approach is crucial.

Budgeting and Saving: Create a detailed budget to track expenses and identify areas for reduction. Increase your savings rate to build a financial buffer against rising prices. Consider automating savings transfers to ensure consistency.

Debt Management: Prioritize paying down high-interest debt, such as credit cards, to reduce the impact of inflation on your repayments. Explore options for refinancing loans at lower interest rates.

Investing: Consider inflation-hedging investments. Stocks and real estate historically perform well during inflationary periods, though they involve inherent risk. Diversify your portfolio to mitigate risk.

Diversify Income Streams: Explore opportunities to increase your income through a side hustle, freelance work, or investment income. This will help you offset the effects of inflation on your purchasing power.

Monitor Expenses: Regularly review your spending habits and adapt to rising prices. Look for cheaper alternatives without compromising essential needs.

Financial Education: Stay informed about economic trends and inflation rates. This knowledge empowers you to make informed financial decisions and adjust your strategies as needed.