Are you yearning for financial freedom? Tired of living paycheck to paycheck and dreaming of a life free from financial stress? This comprehensive guide, “Financial Freedom: How to Achieve It Step by Step,” provides a practical roadmap to achieving your financial goals. Learn proven strategies for budgeting, saving, investing, and debt management, empowering you to take control of your finances and build lasting wealth. Discover how to create a personalized financial plan that aligns with your aspirations and paves the way towards a secure and fulfilling future.

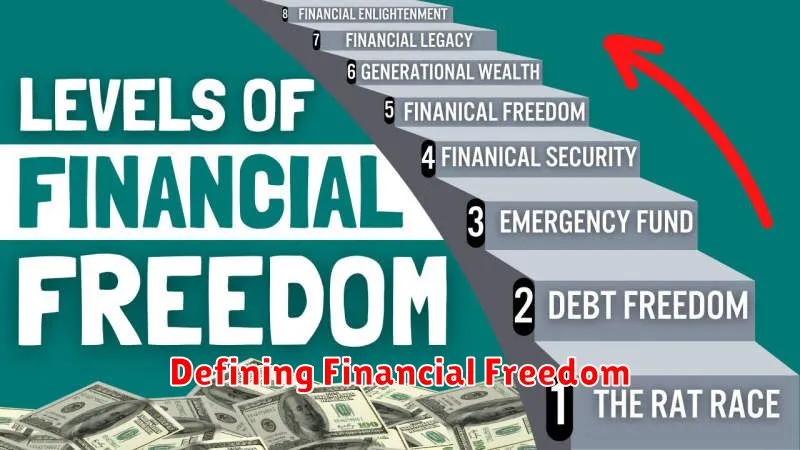

Defining Financial Freedom

Financial freedom is the state of having enough income and assets to cover all your expenses without having to actively work for money. It’s not necessarily about having millions; it’s about having the financial security to live the life you choose, free from the constant worry of making ends meet.

This involves having your passive income exceed your expenses. Your assets, such as investments and real estate, generate enough cash flow to support your lifestyle. This allows you the freedom to pursue passions, spend time with loved ones, or simply enjoy the peace of mind that comes with financial security. It’s about having control over your time and resources, independent of employment.

Importantly, the definition of financial freedom is personal. What constitutes financial freedom for one individual may differ significantly for another. The key lies in achieving a state where your finances work for you, not the other way around. It’s about creating a sustainable financial foundation that supports your desired lifestyle.

Steps to Take for Financial Independence

Achieving financial independence requires a multi-faceted approach. It’s not a quick fix, but a journey requiring consistent effort and discipline.

1. Budgeting and Tracking Expenses: Begin by meticulously tracking your income and expenses. This provides a clear understanding of your current financial situation, identifying areas for potential savings. Utilize budgeting apps or spreadsheets to streamline this process.

2. Debt Management: Aggressively tackle high-interest debts like credit cards. Consider debt consolidation or balance transfers to lower interest rates. Prioritize paying down debt strategically to minimize interest payments.

3. Emergency Fund: Build an emergency fund covering 3-6 months of living expenses. This safety net protects against unexpected events, preventing you from going into debt during unforeseen circumstances.

4. Investing: Once you’ve established an emergency fund and are managing debt effectively, start investing. Explore diverse investment options based on your risk tolerance and financial goals. Consider index funds, ETFs, or individual stocks.

5. Increase Income Streams: Explore ways to increase your income. This could involve a side hustle, freelancing, or seeking a higher-paying job. Diversifying income streams enhances financial security.

6. Regular Review and Adjustment: Regularly review your budget, investment portfolio, and financial goals. Adapt your strategy as needed, ensuring it aligns with your evolving circumstances and objectives. Consistent monitoring is crucial for long-term success.

Budgeting and Expense Tracking

Achieving financial freedom requires a firm grasp of your finances. Budgeting is the cornerstone of this process. It involves creating a detailed plan outlining your expected income and expenses for a specific period. This allows you to understand where your money goes and identify areas for potential savings.

Expense tracking is crucial for effective budgeting. This involves meticulously recording every transaction, whether it’s a large purchase or a small coffee. Numerous methods exist, from manual spreadsheets to budgeting apps. Consistent tracking provides accurate data to inform your budget adjustments and spending habits.

By diligently tracking your expenses and creating a realistic budget, you gain valuable insights into your financial situation. This clarity empowers you to make informed decisions, reduce unnecessary spending, and ultimately, pave the way towards financial freedom. Regular review and adjustments to your budget are essential to ensure it remains relevant and effective.

Building Multiple Income Streams

Financial freedom often hinges on diversifying income. Building multiple income streams mitigates risk and accelerates wealth accumulation. This strategy reduces reliance on a single source of income, offering security and flexibility.

Consider various avenues: passive income like rental properties or dividend-paying stocks; active income from a side hustle or freelance work; and portfolio income from investments. The key is to identify opportunities aligning with your skills and resources.

Careful planning is crucial. Start small, perhaps with a low-investment side hustle, and gradually expand as you gain experience and capital. Track income and expenses meticulously to monitor progress and make informed decisions. Remember, consistency and patience are vital in building a robust and sustainable income portfolio.

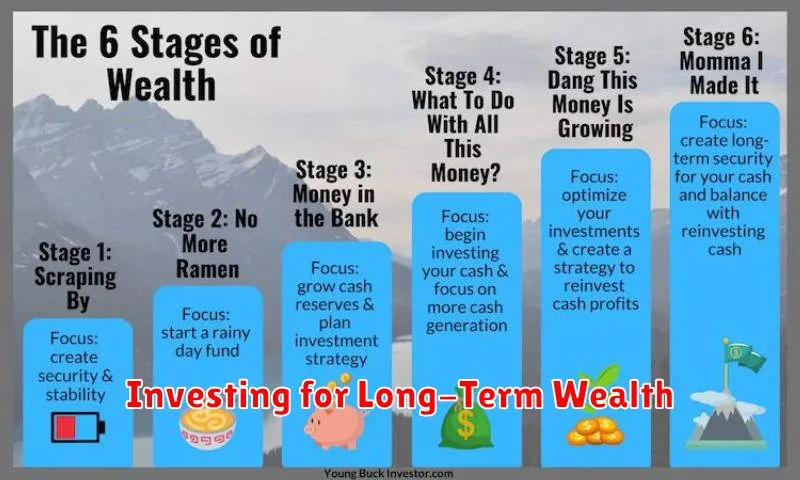

Investing for Long-Term Wealth

Achieving financial freedom often hinges on long-term investing. It’s a crucial strategy for building wealth steadily over time and securing your financial future.

Diversification is key. Don’t put all your eggs in one basket. Spread your investments across different asset classes like stocks, bonds, and real estate to mitigate risk. Consider a mix of growth stocks for higher potential returns and value stocks for stability.

Dollar-cost averaging is a powerful technique. Invest a fixed amount regularly, regardless of market fluctuations. This helps you avoid trying to time the market and reduces the impact of volatility.

Compounding is your greatest ally. Earning returns on your initial investment and reinvesting those returns allows your wealth to grow exponentially over time. The earlier you start, the greater the benefit of compounding.

Long-term perspective is paramount. Ignore short-term market swings and focus on your long-term financial goals. Patience and discipline are crucial for success in long-term investing.

Consider seeking advice from a qualified financial advisor. They can help you create a personalized investment plan tailored to your risk tolerance, financial goals, and time horizon.

Debt-Free Living Strategies

Achieving financial freedom often hinges on effectively managing and eliminating debt. A strategic approach is crucial.

Create a Budget: Track your income and expenses meticulously. Identify areas where you can reduce spending and allocate funds towards debt repayment.

Prioritize Debt: Employ methods like the debt snowball (paying off smallest debts first for motivation) or the debt avalanche (tackling highest-interest debts first for optimal savings).

Increase Income: Explore avenues for supplemental income, such as a part-time job, freelancing, or selling unused possessions. Every extra dollar accelerates debt reduction.

Negotiate with Creditors: Contact your creditors to discuss potential lower interest rates or payment plans. This can significantly reduce your overall debt burden.

Seek Professional Guidance: If overwhelmed, consider consulting a financial advisor or credit counselor for personalized strategies and support.

Avoid New Debt: Once you’ve embarked on your debt-free journey, resist accumulating new debt. This prevents setbacks and maintains momentum towards financial freedom.

Retirement Planning and Passive Income

Financial freedom often hinges on securing a comfortable retirement. A crucial component of this is developing a robust retirement plan that goes beyond relying solely on traditional savings and pensions.

Passive income streams are vital for supplementing retirement income. These are earnings generated with minimal ongoing effort, allowing for financial stability even after ceasing full-time employment. Examples include rental income from real estate, dividends from stocks, royalties from intellectual property, or earnings from online businesses.

Planning for passive income should start early. This involves identifying potential avenues for generating passive income, carefully evaluating the risks and returns involved, and gradually building these streams over time. It requires consistent investment and strategic decision-making.

Diversification of passive income sources is crucial to mitigating risk. Relying on a single stream can be precarious. A diversified portfolio ensures a more stable and resilient income source during retirement.

Retirement planning and passive income generation are interconnected. A well-structured retirement plan incorporates strategies for building passive income to supplement savings and create long-term financial security.

Overcoming Financial Challenges

Achieving financial freedom requires confronting and overcoming inevitable financial challenges. A crucial first step is creating a realistic budget, meticulously tracking income and expenses to identify areas for improvement. This involves prioritizing essential spending and minimizing non-essential ones.

Debt management is paramount. Prioritize paying down high-interest debts like credit cards first, employing strategies like the debt snowball or avalanche method. Negotiating with creditors for lower interest rates or payment plans can significantly alleviate the burden.

Unexpected expenses can derail progress. Building an emergency fund, ideally covering 3-6 months of living expenses, provides a crucial safety net. This fund acts as a buffer against unforeseen circumstances, preventing you from accumulating further debt.

Seeking financial literacy is essential. Educate yourself on personal finance topics such as investing, saving, and budgeting through books, courses, or reputable financial advisors. This empowers you to make informed financial decisions and effectively manage your resources.

Finally, developing good saving habits is crucial. Automate savings by setting up regular transfers from your checking account to your savings account. Even small consistent savings contribute significantly over time.