Choosing the right investment app can be daunting, especially for beginners. This article reviews the best investment apps available, designed to simplify the process for those new to the world of investing. We’ll explore user-friendly interfaces, low fees, educational resources, and diverse investment options, helping you find the perfect platform to start your investment journey. Discover how to build a strong financial future with our curated list of the top beginner-friendly investment apps.

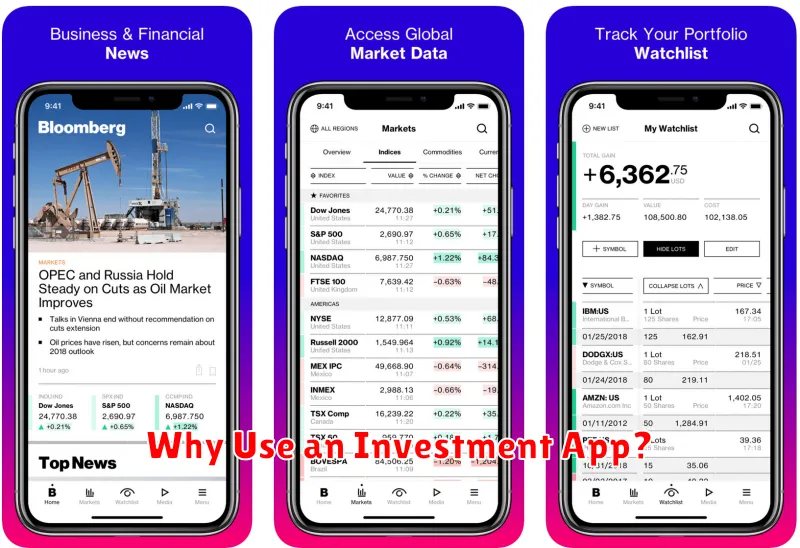

Why Use an Investment App?

Investment apps offer a convenient and accessible entry point into the world of investing, particularly for beginners. They simplify the process, making it easier to start investing even with limited financial knowledge or experience.

Ease of Use: Many apps feature user-friendly interfaces and intuitive designs, eliminating the complexity often associated with traditional brokerage accounts. This makes it straightforward to research investments, execute trades, and monitor your portfolio.

Accessibility: Investment apps are typically available on smartphones and tablets, allowing you to manage your investments anytime, anywhere. This accessibility promotes consistent engagement and allows for quick reactions to market changes.

Educational Resources: Many apps provide educational resources, such as tutorials, articles, and investment guides, helping beginners to build their financial literacy and make informed investment decisions. This onboarding support is crucial for new investors.

Lower Fees: Some investment apps offer lower fees compared to traditional brokerage firms, making them a more cost-effective option for smaller investments or beginners with limited capital. Cost transparency is a key benefit.

Automated Investing: Many apps offer automated investment options, such as robo-advisors, that take the guesswork out of investing. These tools handle portfolio diversification and rebalancing based on your risk tolerance and financial goals, particularly helpful for those new to investing.

Top Investment Apps for Beginners

Choosing the right investment app is crucial for beginners. Simplicity and educational resources are key factors to consider.

Robinhood offers a user-friendly interface and commission-free trading, making it a popular choice for newcomers. However, its limited research tools might not suit all beginners.

Acorns is excellent for those starting with small amounts. Its round-up feature automatically invests spare change, fostering a habit of consistent investing. However, its fees might be a concern for larger portfolios.

Stash provides fractional shares, allowing beginners to invest in high-priced stocks without needing a large initial investment. Its educational content aids in building financial literacy. Keep in mind its fees structure.

Betterment stands out with its robo-advisor features and automated portfolio management. This is ideal for those seeking hands-off investing, but the fees can be higher than other options.

Ultimately, the best app depends on individual needs and investment goals. Consider fee structures, available investment options, and the level of user support offered before making a decision.

How to Choose the Right App

Choosing the right investment app is crucial for beginners. Consider these key factors:

Ease of use: The app should be intuitive and easy to navigate, even for those with limited investment experience. Look for clear explanations and simple interfaces.

Fees and commissions: Compare the fees charged for trading, account maintenance, and other services. Low or transparent fee structures are preferable.

Investment options: Determine which investment types you are interested in (e.g., stocks, bonds, ETFs). Ensure the app offers access to those asset classes.

Security and regulation: Choose an app from a reputable broker that is registered and regulated by relevant authorities. Check for security features like two-factor authentication.

Educational resources: Many apps offer educational materials and tools to help beginners learn about investing. Access to learning resources can be a significant advantage.

Customer support: Reliable and responsive customer support is essential. Consider the availability of various support channels (e.g., phone, email, chat).

By carefully considering these factors, beginners can select an investment app that aligns with their needs and goals, promoting a positive and successful investing journey.

Robo-Advisors vs Manual Investing

For beginner investors, choosing between robo-advisors and manual investing presents a key decision. Robo-advisors offer automated portfolio management based on your risk tolerance and financial goals. They are generally low-cost and require minimal effort, making them ideal for those new to investing. However, they offer less control and customization compared to manual investing.

Manual investing, on the other hand, requires more research and active management. You select individual stocks, bonds, or mutual funds, giving you greater control over your portfolio’s composition. While offering more potential for higher returns, manual investing demands more time, knowledge, and carries a higher risk of making costly mistakes due to emotional decision-making or a lack of expertise.

The best approach depends on your individual circumstances and comfort level. If convenience and simplicity are prioritized, a robo-advisor is a suitable starting point. If you have the time and inclination to research and actively manage your investments, manual investing might be more rewarding, but demands greater diligence and financial literacy.

Security and Regulations for Investment Apps

Choosing a secure investment app is crucial for beginners. Look for apps registered with relevant financial authorities like the Securities and Exchange Commission (SEC) in the US or equivalent bodies in your region. This ensures the app adheres to regulatory standards designed to protect investors.

Data security is another key consideration. Check the app’s privacy policy to understand how your personal and financial information is handled. Look for features like two-factor authentication (2FA) and encryption to enhance security.

While regulations offer a degree of protection, remember that no investment is entirely risk-free. Understand the inherent risks associated with investing before using any app. Carefully review the app’s terms of service and associated risks before investing your money.

Always maintain healthy skepticism and report any suspicious activity to the appropriate authorities. Due diligence is essential before entrusting any app with your financial information.

Investment Strategies Using Apps

Investment apps offer various strategies accessible to beginners. Dollar-cost averaging (DCA) is a popular approach, involving regular investments regardless of market fluctuations. This mitigates risk by preventing large lump-sum investments at potentially high market peaks. Many apps automate DCA, simplifying the process.

Index fund investing provides diversified exposure to a broad market segment. Apps often offer low-cost index funds, minimizing expense ratios and maximizing returns. This passive strategy requires minimal research and is ideal for beginners.

Setting financial goals within the app can be beneficial. Defining short-term (e.g., emergency fund) and long-term (e.g., retirement) objectives helps guide investment choices and track progress. Apps often include goal-setting features and progress trackers.

Tax-advantaged accounts like Roth IRAs and 401(k)s can be opened and managed through some apps. These accounts offer significant tax benefits, making them attractive long-term investment vehicles. Check if your chosen app supports these accounts.

Diversification across asset classes (stocks, bonds, etc.) is crucial to manage risk. Apps often allow you to allocate investments across various funds or asset types, promoting a diversified portfolio, even with a limited budget. Remember to consider your risk tolerance when deciding on an asset allocation.

Regular monitoring and rebalancing are important. While apps automate much of the investing process, periodically checking your portfolio’s performance and rebalancing to maintain your target asset allocation is recommended. Many apps provide tools to facilitate this process.

Common Mistakes When Using Investment Apps

One common mistake is failing to define clear financial goals before investing. Without a plan, it’s easy to make impulsive decisions and stray from your long-term objectives.

Another frequent error is over-diversification or under-diversification. Too many investments can complicate management, while insufficient diversification exposes you to unnecessary risk. Finding the right balance is key.

Ignoring fees and expenses can significantly impact returns over time. Carefully compare the fee structures of different apps and choose one that aligns with your investment strategy and budget.

Many beginners fall prey to emotional investing, driven by market fluctuations rather than a well-defined strategy. Avoid making rash decisions based on short-term market movements; stick to your plan.

Finally, it’s crucial to understand the risks involved. Investing always carries some level of risk, and it’s important to carefully research investments before committing your money. Don’t invest in anything you don’t understand.

Future of Digital Investing

The future of digital investing is bright, driven by several key trends. Accessibility will continue to improve, with more user-friendly platforms and lower barriers to entry. This democratization of investing will empower a broader range of individuals to participate in the market.

Artificial intelligence (AI) and machine learning (ML) will play increasingly significant roles. AI-powered robo-advisors will offer personalized investment strategies and portfolio management, while ML algorithms will enhance risk assessment and prediction capabilities. This will lead to more efficient and potentially higher-return investment strategies.

Personalization will be paramount. Investment apps will leverage data analytics to tailor recommendations and investment options to individual investor profiles, risk tolerances, and financial goals. This will lead to a more customized and engaging investment experience.

Blockchain technology and cryptocurrencies are poised to further disrupt the landscape. While still nascent, decentralized finance (DeFi) platforms could offer greater transparency, security, and efficiency in the future.

Despite these advancements, financial literacy remains crucial. Beginners should focus on understanding basic investment principles and managing risk before embracing the latest technological advancements.