Are you ready to take control of your financial future and achieve financial freedom? This comprehensive guide, Mastering Personal Finance: A Step-by-Step Guide, provides a clear and actionable path to mastering your personal finances. Learn how to budget effectively, eliminate debt, save and invest wisely, and ultimately build a secure financial foundation. Whether you’re a beginner struggling with debt management or an experienced investor looking to optimize your portfolio, this guide offers valuable strategies and practical tips to help you achieve your financial goals.

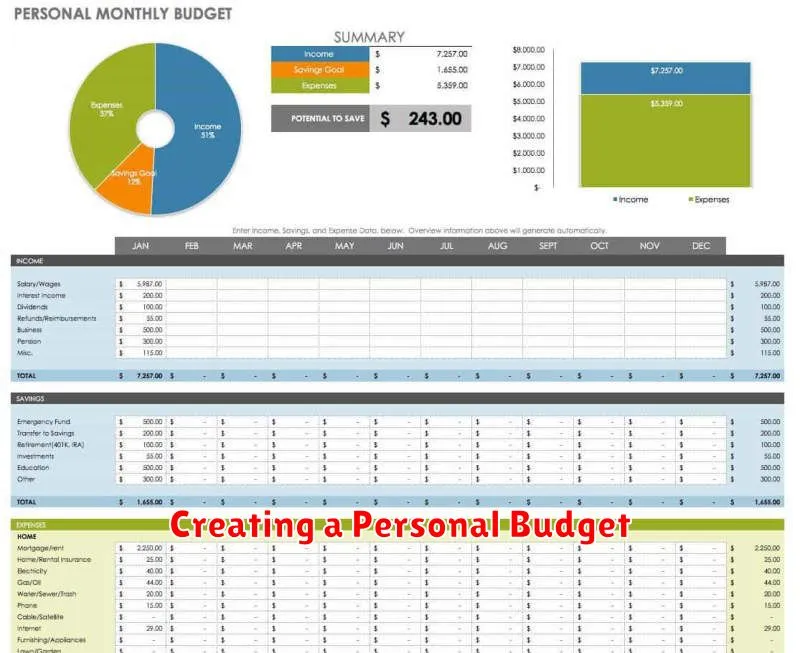

Creating a Personal Budget

Creating a personal budget is a crucial first step in mastering personal finance. It involves tracking your income and expenses to understand your financial situation.

Start by listing all sources of income, including your salary, any part-time jobs, and investments. Then, meticulously record all your expenses. Categorize these expenses (e.g., housing, transportation, food, entertainment) for a clearer picture.

Use budgeting apps or spreadsheets to simplify the process. Many tools offer automated features to track transactions and generate reports. Consider using the 50/30/20 rule as a guideline: allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

Regularly review and adjust your budget. Your financial situation can change, requiring adjustments to your spending and saving habits. Consistency is key to successful budgeting.

A well-structured budget provides a clear understanding of your financial health, allowing you to make informed decisions about spending, saving, and investing, ultimately leading to greater financial stability.

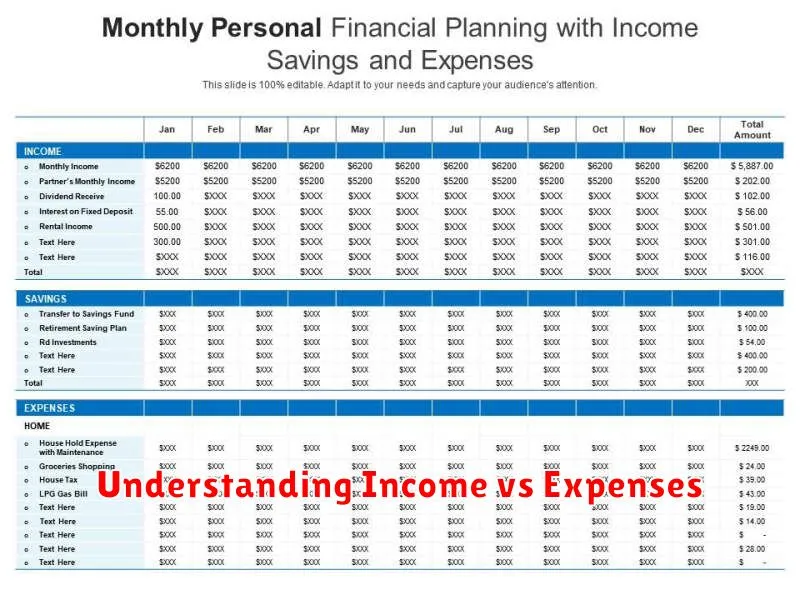

Understanding Income vs Expenses

Income represents all the money you receive, including your salary, wages, investments, and other sources of revenue. Accurately tracking your income is the first step to effective financial management.

Expenses are all the money you spend. These can be categorized as fixed expenses (consistent monthly payments like rent or mortgage) and variable expenses (fluctuating costs such as groceries or entertainment). Understanding where your money goes is crucial for budgeting.

The difference between your total income and total expenses is your net income (or net profit). A positive net income indicates you’re saving money, while a negative net income means you’re spending more than you earn.

Careful tracking of both income and expenses is vital for creating a realistic budget and achieving your financial goals. Using budgeting tools, spreadsheets, or apps can simplify this process.

Effective Saving Techniques

Mastering personal finance requires effective saving techniques. Begin by creating a realistic budget, tracking your income and expenses to identify areas for reduction. Automate your savings by setting up recurring transfers to a dedicated savings account. Consider utilizing the 50/30/20 rule, allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

Explore high-yield savings accounts or other investment vehicles to maximize returns on your savings. Prioritize paying off high-interest debt before aggressively saving, as this reduces financial burden and frees up more money for savings. Regularly review your budget and savings goals to ensure you’re on track and adjust as needed. Developing strong saving habits is crucial for long-term financial success.

Small changes can make a big difference. Look for opportunities to reduce unnecessary expenses, such as dining out or entertainment subscriptions. Embrace a mindful spending approach, considering the value of purchases before making them. Setting short-term and long-term savings goals, such as an emergency fund or a down payment on a house, provides motivation and focus.

Debt Management Strategies

Effective debt management is crucial for achieving strong personal finances. A key first step is creating a detailed budget to track income and expenses, identifying areas for potential savings.

Next, prioritize debts. Consider strategies like the debt snowball (paying off smallest debts first for motivation) or the debt avalanche (paying off highest-interest debts first for long-term savings). Both approaches require disciplined adherence to a repayment plan.

Negotiating with creditors can be beneficial. Explore options such as debt consolidation (combining multiple debts into one lower-interest loan), or debt settlement (negotiating a lower payoff amount). Be aware of the potential impact on credit score.

Consider seeking professional guidance. A financial advisor can provide personalized strategies and support, helping to navigate complex debt situations and develop long-term financial plans.

Building an emergency fund is vital. This buffer protects against unexpected expenses that could derail debt repayment efforts and prevents further debt accumulation.

How to Improve Your Credit Score

A strong credit score is crucial for securing loans, mortgages, and even some rental agreements. Improving your score requires consistent effort and discipline. Here’s how:

Pay your bills on time: This is the single most important factor affecting your credit score. Even one missed payment can negatively impact your standing. Set up automatic payments to avoid late fees and missed deadlines.

Keep your credit utilization low: Your credit utilization ratio (the amount of credit you use compared to your total available credit) significantly impacts your score. Aim to keep this ratio below 30%, ideally much lower. Paying down existing balances is key.

Maintain a diverse credit history: Having a mix of credit accounts (credit cards, installment loans) demonstrates responsible credit management. However, avoid opening too many accounts in a short period.

Check your credit report for errors: Regularly review your credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion) for any inaccuracies. Dispute any errors immediately.

Don’t close old credit accounts: The length of your credit history is a significant factor. Closing old accounts, even if unused, can shorten your credit history and negatively impact your score.

Be patient: Improving your credit score takes time. Consistent responsible financial behavior will yield positive results over time. Monitor your progress regularly.

Smart Spending Habits

Developing smart spending habits is crucial for mastering personal finance. It involves a conscious effort to manage your money effectively, ensuring your expenses align with your financial goals.

Budgeting is paramount. Create a realistic budget that tracks your income and expenses, identifying areas where you can cut back. Utilize budgeting apps or spreadsheets for easier tracking.

Prioritize needs over wants. Differentiate between essential expenses (housing, food, transportation) and non-essential spending (entertainment, dining out). Consciously reduce unnecessary expenditures.

Track your spending diligently. Monitor your transactions regularly to understand where your money is going. This awareness helps identify spending patterns and areas for improvement.

Avoid impulse purchases. Give yourself time to consider significant purchases. This prevents regrettable spending and helps make informed decisions.

Explore cost-saving alternatives. Look for cheaper alternatives for everyday items and services without compromising quality. This could include cooking at home more often or opting for public transport.

Set financial goals. Defining short-term and long-term goals provides direction for your spending habits. This allows you to prioritize expenses that contribute to your goals.

Review and adjust your budget regularly. Your financial situation and priorities may change over time. Regularly reviewing and adjusting your budget ensures it remains relevant and effective.

Emergency Funds and Why You Need One

An emergency fund is a crucial component of sound personal finance. It’s a readily accessible savings account specifically designed to cover unexpected expenses.

Why is it necessary? Life throws curveballs. Job loss, medical emergencies, car repairs – these unforeseen events can significantly impact your finances. An emergency fund acts as a safety net, preventing you from accumulating debt or depleting your long-term savings to handle these situations.

How much should you save? Financial advisors generally recommend having 3-6 months’ worth of living expenses in your emergency fund. This amount provides a cushion to cover essential costs like rent, utilities, and groceries during a period of financial hardship.

Building your emergency fund requires discipline and prioritization. Start small, even with a modest amount each month. Gradually increase your contributions as your income allows. The peace of mind that comes with having an emergency fund is invaluable.

Long-term Financial Planning

Long-term financial planning focuses on achieving your long-term financial goals, such as retirement, a down payment on a house, or funding your children’s education. It requires a comprehensive approach encompassing several key areas.

Retirement planning is a crucial component. This involves determining your desired retirement lifestyle, estimating your retirement expenses, and calculating how much you need to save to achieve your goals. Utilizing tools like retirement calculators and considering different investment options, such as 401(k)s and IRAs, are vital steps.

Estate planning is another essential aspect. This involves creating a will, establishing trusts, and designating beneficiaries for your assets. It ensures that your assets are distributed according to your wishes and protects your loved ones after your passing. Consulting with an estate planning attorney is highly recommended.

Investment strategies play a critical role in long-term financial planning. Diversifying your investments across different asset classes, such as stocks, bonds, and real estate, helps mitigate risk and maximize returns over the long term. Understanding your risk tolerance is key to choosing the right investment portfolio.

Regular review and adjustments are necessary to ensure your plan remains aligned with your evolving financial situation and goals. Life circumstances change, and your financial plan should adapt accordingly. Periodically reviewing your progress and making necessary adjustments will enhance your chances of achieving your long-term financial objectives.