Planning for a secure and comfortable retirement requires a proactive investment strategy. This article explores the best investment strategies for retirement planning, examining diverse options such as 401(k)s, IRAs, and real estate investments to help you build a robust retirement portfolio. We’ll delve into risk management, asset allocation, and long-term growth strategies to guide you towards achieving your financial goals and securing a financially fulfilling retirement. Learn how to maximize your retirement savings and navigate the complexities of pension planning and investment diversification.

Why Retirement Planning is Important

Retirement planning is crucial for securing your financial future and ensuring a comfortable lifestyle after you stop working. Adequate planning mitigates the risk of outliving your savings, a significant concern for many individuals.

Financial security in retirement allows for greater independence and freedom to pursue personal interests and goals, without the constant worry of financial strain. It provides a safety net against unexpected medical expenses or other unforeseen circumstances.

Starting early is key, as compounding returns on investments over time significantly boost your retirement nest egg. Proper planning allows you to make informed decisions about your savings rate, investment choices, and withdrawal strategy, optimizing your retirement funds.

Ultimately, retirement planning offers peace of mind. Knowing you have a plan in place reduces stress and anxiety about your future, enabling you to enjoy your working years to the fullest, knowing your retirement is secure.

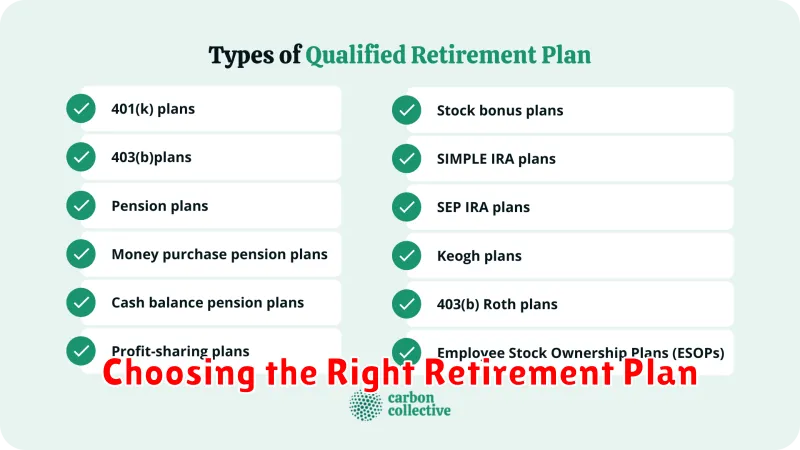

Choosing the Right Retirement Plan

Selecting the appropriate retirement plan is crucial for securing your financial future. The best choice depends on several factors, including your age, income, risk tolerance, and employer-sponsored benefits.

401(k) plans, offered by many employers, allow pre-tax contributions that reduce your taxable income and often include employer matching. Traditional IRAs offer tax-deductible contributions, while Roth IRAs provide tax-free withdrawals in retirement. Employer-sponsored pension plans provide a guaranteed income stream upon retirement, but these are becoming less common.

Consider the tax implications of each plan. Traditional plans offer tax advantages now, but withdrawals are taxed in retirement. Roth plans offer tax-free withdrawals, but contributions are not tax-deductible. Carefully evaluate the fees and expenses associated with each plan, as these can significantly impact your returns.

It’s wise to diversify your retirement savings across multiple accounts to mitigate risk. Consulting with a financial advisor can provide personalized guidance based on your individual circumstances and goals.

Saving Early for a Secure Future

One of the most impactful strategies for successful retirement planning is starting to save early. The power of compound interest is significant; the earlier you begin investing, the more time your money has to grow exponentially. Even small, consistent contributions made early in your career can accumulate into a substantial retirement nest egg.

Time is your greatest asset. The longer your investments have to grow, the less you need to contribute each period to reach your financial goals. Early saving mitigates the risk of needing to make drastically larger contributions later in life when income may be less predictable.

Flexibility is another key advantage. Beginning early allows for greater flexibility in adjusting your investment strategy based on market conditions and personal circumstances. You can adapt your savings plan if your income fluctuates or if you experience unexpected life events. This adaptability becomes increasingly challenging if you start saving later in life.

In short, prioritizing early saving for retirement significantly enhances the chances of achieving a financially secure future. It leverages the power of compounding, provides time to adjust your strategy, and reduces the pressure of needing to save aggressively later on.

Investment Options for Retirement

Planning for retirement requires careful consideration of various investment options. The best strategy depends on your risk tolerance, time horizon, and financial goals.

Stocks offer the potential for high returns but also carry significant risk. Bonds provide more stability and lower risk, but generally offer lower returns. A balanced portfolio, combining both stocks and bonds, is a common approach for diversification.

Mutual funds and exchange-traded funds (ETFs) offer diversified investments in a single package, making them convenient options for managing a retirement portfolio. Real estate can be another option, offering potential for both income generation and appreciation, but requires significant capital and management.

Annuities provide guaranteed income streams in retirement, but often come with high fees and limited liquidity. Retirement accounts such as 401(k)s and IRAs offer tax advantages and are specifically designed for retirement savings.

It’s crucial to consult with a financial advisor to determine the most suitable investment strategy based on your individual circumstances. They can help you navigate the complexities of retirement planning and create a personalized plan to achieve your financial goals.

Understanding Tax Benefits in Retirement

Retirement planning often involves leveraging tax advantages to maximize savings and minimize your tax burden in later life. Understanding these benefits is crucial for effective financial planning.

Retirement accounts like 401(k)s and Traditional IRAs offer significant tax benefits. Contributions are often tax-deductible, reducing your taxable income in the present. However, withdrawals in retirement are typically taxed as ordinary income.

Conversely, Roth IRAs allow for tax-free withdrawals in retirement. While contributions aren’t tax-deductible, the growth and withdrawals are tax-free, offering a potentially advantageous long-term strategy. The best choice depends on your current and projected tax bracket.

Tax-advantaged investments beyond retirement accounts can also play a role. Municipal bonds, for example, often offer tax-exempt interest, making them attractive for those in higher tax brackets.

Careful planning is key. Consulting a financial advisor can help you determine the best mix of tax-advantaged accounts and investment strategies to align with your individual circumstances and retirement goals.

Planning for Healthcare Costs

Healthcare expenses represent a significant, often underestimated, portion of retirement costs. Planning ahead is crucial to avoid depleting your retirement savings prematurely.

Estimate your healthcare needs. Consider factors like age, pre-existing conditions, and anticipated lifestyle. Consult with healthcare professionals and utilize online tools to gain a clearer picture of potential expenses.

Explore healthcare coverage options. Medicare is a vital resource, but supplemental insurance (Medigap) or Advantage plans can help cover gaps in coverage. Consider long-term care insurance to address potential nursing home or assisted living needs.

Develop a savings strategy. Designate a portion of your retirement savings specifically for healthcare. Consider health savings accounts (HSAs) if eligible, as they offer tax advantages.

Regularly review and adjust your plan. Healthcare costs fluctuate, and your needs may change. Periodically reassess your strategy to ensure it remains aligned with your circumstances.

Common Retirement Mistakes to Avoid

Failing to start saving early is a critical mistake. The power of compounding returns significantly diminishes when you delay.

Not diversifying investments exposes you to unnecessary risk. A well-diversified portfolio mitigates potential losses from any single asset class.

Ignoring inflation can severely erode your retirement savings. Plan for inflation to ensure your money maintains its purchasing power.

Underestimating retirement expenses is common. Create a detailed budget considering healthcare, travel, and leisure activities.

Withdrawing too much, too soon can deplete your retirement funds prematurely. Develop a sustainable withdrawal strategy.

Failing to adjust your investment strategy as you near retirement increases risk. Shift towards less volatile investments to protect your principal.

Neglecting estate planning can complicate the distribution of your assets after retirement. Consult with a financial advisor or estate lawyer.

Ignoring professional advice can lead to costly errors. Seeking guidance from a qualified financial advisor helps optimize your retirement plan.

How to Adjust Your Savings Over Time

As your income and life circumstances change, so should your retirement savings strategy. Regularly reviewing and adjusting your savings plan is crucial for maximizing your retirement nest egg.

Increased income allows for increased contributions. Consider boosting your contributions to retirement accounts by a percentage or a fixed dollar amount whenever you receive a raise or bonus. This allows you to take advantage of compounding returns earlier.

Life events, such as marriage, children, or purchasing a home, may necessitate adjusting your savings rate. You may need to temporarily reduce contributions to manage immediate expenses, but aim to return to your previous contribution level or increase it as soon as financially feasible. Consider adjusting your investment allocation to align with your risk tolerance and time horizon, potentially reducing risk as you approach retirement.

Market fluctuations require a long-term perspective. Don’t panic-sell during market downturns. Instead, stick to your investment plan and rebalance your portfolio periodically to maintain your target asset allocation. Consider dollar-cost averaging to mitigate the impact of market volatility.

Retirement projections should be regularly reviewed and updated. Use online tools or consult a financial advisor to estimate your retirement needs and adjust your savings accordingly. Factors such as inflation, healthcare costs, and longevity should be taken into account. Regularly recalculating your retirement needs ensures your savings remain aligned with your goals.

Professional guidance can be invaluable. A financial advisor can provide personalized recommendations based on your individual circumstances and help you create a sustainable long-term savings plan that adapts to life’s changes. They can also help you navigate complex investment strategies and tax optimization.