Understanding your credit score is crucial for achieving your financial goals. This Credit Score 101 guide will provide you with a comprehensive understanding of what constitutes a credit score, how it’s calculated, and, most importantly, actionable strategies to build and improve yours. Whether you’re a first-time borrower looking to establish credit or aiming to increase your credit score for better loan terms, this article will equip you with the knowledge you need to navigate the world of credit successfully. Learn how to monitor your credit report, identify and address negative marks, and develop healthy credit habits that will benefit you for years to come.

What is a Credit Score?

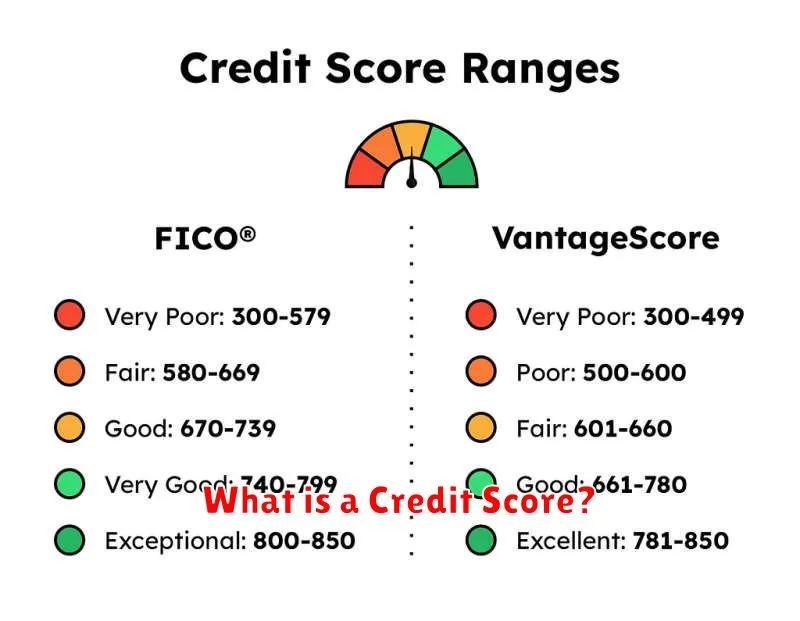

A credit score is a three-digit numerical representation of your creditworthiness. It’s a summary of your past borrowing and repayment behavior, used by lenders to assess the risk of lending you money.

Lenders use credit scores to determine whether to approve your loan application, and if approved, what interest rate to offer. A higher credit score generally indicates lower risk to the lender, resulting in more favorable loan terms.

Several different credit scoring models exist, with the most common being the FICO score. These models analyze various factors from your credit report, including payment history, amounts owed, length of credit history, credit mix, and new credit.

Your credit report, compiled by credit bureaus, contains the data used to calculate your credit score. It’s crucial to regularly review your credit report for accuracy and identify any potential errors.

How Credit Scores are Calculated

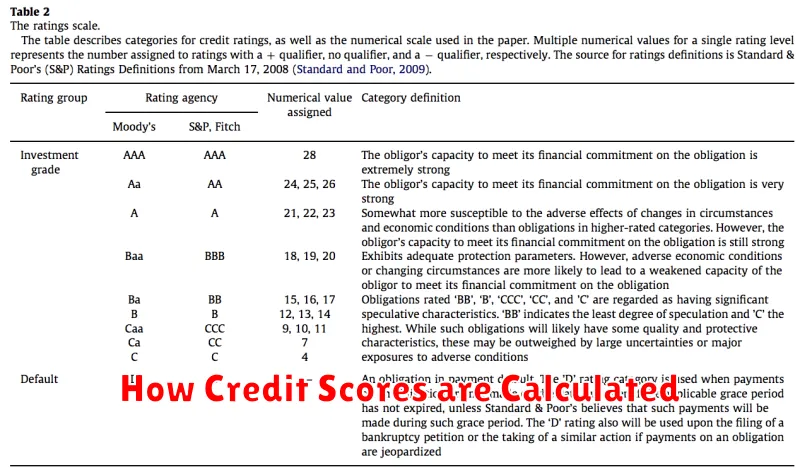

Your credit score is a numerical representation of your creditworthiness, calculated using a complex formula that varies slightly depending on the scoring model used (e.g., FICO, VantageScore). However, the key factors remain consistent across most models.

Payment History is the most significant factor, accounting for approximately 35% of your score. This reflects your consistency in making payments on time. Late or missed payments significantly damage your score.

Amounts Owed (30%) represents your credit utilization ratio – the amount of credit you’re using compared to your total available credit. Keeping this ratio low (ideally below 30%) is crucial for a good score. High utilization suggests a higher risk of default.

Length of Credit History (15%) considers the age of your oldest account and the average age of all your accounts. A longer history demonstrates responsible credit management over time.

New Credit (10%) refers to the frequency of applying for new credit. Numerous recent applications can negatively impact your score, as they signal increased risk.

Credit Mix (10%) examines the variety of credit accounts you possess (e.g., credit cards, installment loans, mortgages). A diverse mix can be viewed favorably, but it’s less important than the other factors.

Understanding these factors allows you to actively manage your credit and improve your score. Consistent on-time payments, low credit utilization, and responsible credit management are key to building a strong credit profile.

Factors That Influence Your Score

Your credit score, a crucial number impacting your financial life, is influenced by several key factors. Understanding these factors is the first step towards building and improving your score.

Payment History is the most significant factor. Late or missed payments severely damage your score. Consistent on-time payments are vital.

Amounts Owed, or your credit utilization ratio, is also critical. Keeping your credit card balances low (ideally under 30% of your credit limit) demonstrates responsible credit management.

Length of Credit History matters. A longer history of responsible credit use generally translates to a higher score. Avoid closing old accounts unless absolutely necessary.

Credit Mix refers to the variety of credit accounts you possess (credit cards, loans, etc.). A diverse mix, managed responsibly, can positively influence your score.

New Credit inquiries, such as applications for new credit cards or loans, can temporarily lower your score. Limit applications to only what you truly need.

Ways to Improve Your Credit Score

Improving your credit score takes time and consistent effort. Paying your bills on time is the most crucial factor. Even one missed payment can negatively impact your score. Make sure to pay at least the minimum amount due by the due date, and ideally, pay more to reduce your outstanding balance.

Keeping your credit utilization ratio low is also vital. This refers to the amount of credit you’re using compared to your total available credit. Aim to keep it below 30%, and ideally, below 10%. Paying down existing balances helps achieve this.

Avoid opening many new credit accounts in a short period. Each application results in a hard inquiry on your credit report, potentially lowering your score. Only apply for credit when truly needed.

Maintain a mix of credit accounts, such as credit cards and installment loans (like auto loans or mortgages), demonstrates responsible credit management, potentially boosting your score. However, don’t open new accounts solely for diversification; only apply when you need the credit.

Finally, monitor your credit report regularly for any errors. Dispute any inaccuracies you find with the relevant credit bureaus (Equifax, Experian, and TransUnion) to correct your credit history. Early detection and correction of errors are key to maintaining a healthy credit score.

How to Check Your Credit Report

Understanding your credit report is crucial for building and improving your credit score. You’re entitled to a free credit report from each of the three major credit bureaus – Equifax, Experian, and TransUnion – once a year through AnnualCreditReport.com. This is the only official source; avoid sites that charge a fee for this service.

To obtain your free report, visit the official website and follow the instructions. You’ll need to provide personal information to verify your identity. Review each report carefully for any inaccuracies or errors. Disputes should be filed directly with the respective credit bureau.

While your credit report doesn’t show your credit score directly, it provides the information used to calculate it. Understanding the details – like your payment history, amounts owed, and length of credit history – helps you identify areas for improvement.

Regularly checking your credit report allows you to monitor your credit health, identify potential fraud, and address any issues promptly. This proactive approach is a key component of managing your finances effectively.

Common Myths About Credit Scores

Understanding your credit score is crucial for financial health, but many myths surround it. Let’s debunk some common misconceptions.

Myth 1: Checking your credit score hurts your credit score. This is false. Checking your own credit score through authorized channels (like your credit card company or annualcreditreport.com) doesn’t negatively impact your score.

Myth 2: Paying off debt immediately eliminates negative impacts. While paying down debt is positive, negative marks from past due accounts remain on your report for several years, impacting your score. Consistent on-time payments are key to improving your score over time.

Myth 3: Only loans affect your credit score. Your credit score incorporates various financial behaviors, including credit card usage, rent payments (if reported), and even utility bills. Responsible management across all credit accounts is vital.

Myth 4: A single missed payment will ruin your credit. While it’s a negative mark, one missed payment won’t automatically destroy your credit. However, consistent late or missed payments significantly harm your score. The impact depends on your overall credit history.

Myth 5: Closing old credit cards improves your score. The age of your accounts contributes to your score. Closing old accounts can shorten your credit history, potentially lowering your score. Instead, consider keeping older accounts open, but using them responsibly.

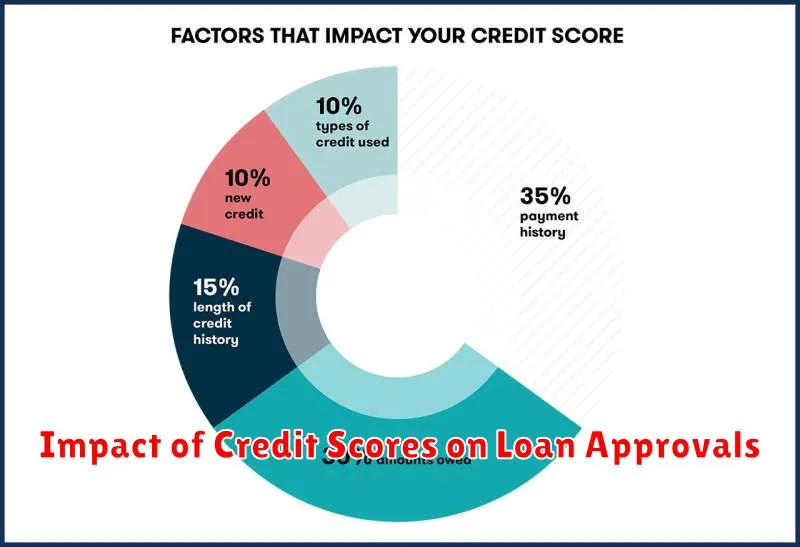

Impact of Credit Scores on Loan Approvals

Your credit score is a crucial factor in determining whether you’ll be approved for a loan and, if so, at what interest rate. Lenders use your credit score to assess your creditworthiness – your ability to repay borrowed money. A higher credit score indicates a lower risk to the lender, leading to a greater likelihood of approval and potentially more favorable loan terms, such as a lower interest rate.

Conversely, a low credit score signals higher risk. Lenders may deny your loan application outright or offer loans with significantly higher interest rates, making the loan more expensive overall. A poor credit history demonstrates a pattern of missed payments or financial mismanagement, making lenders hesitant to extend credit.

Therefore, improving your credit score before applying for a loan can significantly improve your chances of approval and help you secure better terms. Understanding your credit score and actively working to improve it is a critical step in achieving your financial goals.

Long-term Credit Management Strategies

Building and maintaining a strong credit score requires a long-term perspective. It’s not a sprint, but a marathon. Consistent, responsible financial behavior is key.

Diversify your credit by utilizing a mix of credit products, such as credit cards and installment loans. This demonstrates your ability to manage various credit accounts responsibly.

Pay your bills on time, every time. Late payments severely damage your credit score. Set up automatic payments or reminders to avoid this.

Keep credit utilization low. Aim to keep your credit card balances below 30% of your credit limit. This shows lenders you’re managing your debt effectively.

Monitor your credit reports regularly. Review them for errors and signs of identity theft. You can obtain free credit reports annually from each of the three major credit bureaus.

Avoid opening too many new accounts in a short period. Each application for credit results in a hard inquiry on your credit report, which can temporarily lower your score.

Consider a secured credit card if you have limited or damaged credit. This can help you build credit responsibly over time.

Long-term credit management is about establishing and maintaining positive credit habits. By consistently following these strategies, you can build and improve your credit score significantly over time, unlocking better financial opportunities.