Navigating the complex world of insurance can be daunting, but understanding its intricacies is crucial for protecting your assets and financial future. This comprehensive guide, “Understanding Insurance: A Complete Guide,” will demystify various insurance types, including health insurance, auto insurance, home insurance, and life insurance, explaining their coverage, costs, and benefits. We’ll explore key concepts such as premiums, deductibles, and claims, empowering you to make informed decisions and secure the best insurance policies for your individual needs. Learn how to compare insurance providers, avoid costly mistakes, and find affordable coverage.

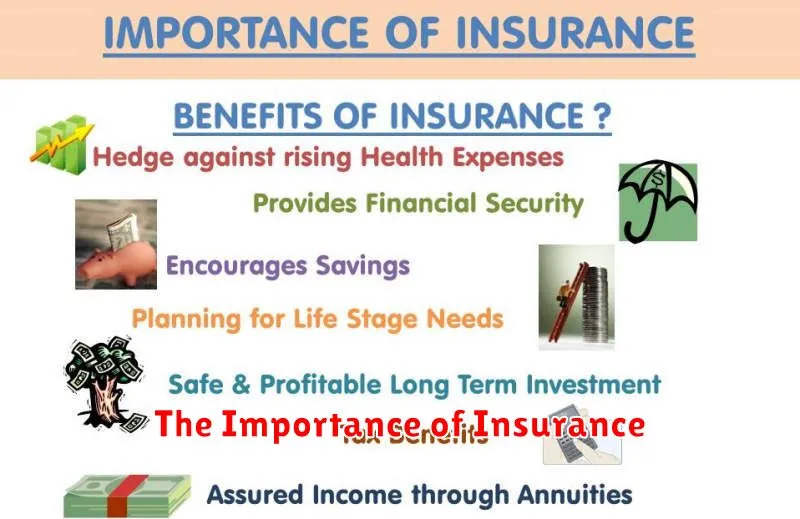

The Importance of Insurance

Insurance plays a crucial role in financial security. It provides a safety net against unforeseen events that could otherwise cause significant financial hardship.

The primary importance lies in its ability to mitigate risk. Unexpected events such as accidents, illnesses, or natural disasters can lead to substantial costs. Insurance helps to transfer that risk from the individual to the insurance company, lessening the potential for devastating financial consequences.

Furthermore, insurance offers peace of mind. Knowing you have protection in place for your assets (home, car, etc.) and your well-being (health, life) allows you to focus on other aspects of your life without the constant worry of catastrophic financial losses.

In essence, insurance is a vital tool for risk management and financial planning, ensuring stability and security for individuals and families.

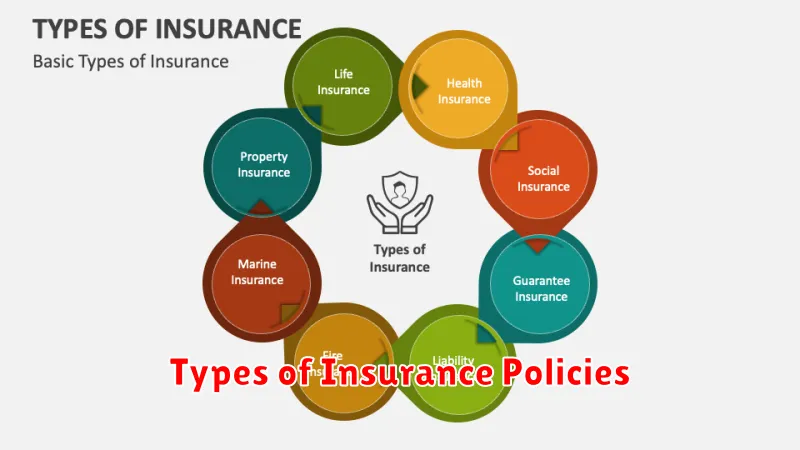

Types of Insurance Policies

Insurance policies are categorized into various types, each designed to cover specific risks. Understanding these categories is crucial for selecting the right coverage.

Health insurance covers medical expenses, including doctor visits, hospital stays, and prescription drugs. Different plans offer varying levels of coverage and cost-sharing.

Auto insurance protects against financial losses resulting from car accidents. It typically includes liability coverage for injuries or damages to others, and potentially collision and comprehensive coverage for your own vehicle.

Homeowners insurance protects your home and its contents from damage or loss due to events like fire, theft, or natural disasters. It also provides liability coverage for accidents occurring on your property.

Life insurance provides a financial payout to designated beneficiaries upon the death of the insured individual. This can help replace lost income and cover expenses for the family.

Disability insurance replaces a portion of your income if you become unable to work due to illness or injury. This can help maintain financial stability during a period of incapacity.

Other types of insurance include business insurance (covering various business risks), travel insurance (covering travel-related emergencies), and umbrella insurance (providing additional liability protection beyond other policies).

The specific types and coverage options available vary by location and insurance provider. It’s essential to carefully review policy details before purchasing.

How to Choose the Right Insurance

Choosing the right insurance involves careful consideration of several key factors. First, assess your needs. What risks are you most concerned about? Homeowners? Auto? Health? Life? Understanding your potential exposures is crucial.

Next, compare quotes from multiple insurers. Don’t solely focus on price; look at coverage details, deductibles, and policy limitations. Read the fine print carefully to understand what’s included and excluded.

Consider the financial stability of the insurance company. Check their ratings with independent agencies to ensure they can pay claims when needed. A reputable company with a strong financial standing offers greater peace of mind.

Review policy terms and conditions thoroughly. Understand the claims process, limitations on coverage, and any exclusions before signing. Ask questions if anything is unclear.

Finally, consider customer service. A responsive and helpful insurer can make a significant difference if you ever need to file a claim. Look for companies with positive customer reviews and readily available support.

Understanding Policy Terms and Conditions

Understanding your insurance policy’s terms and conditions is crucial. These documents detail your coverage, exclusions, and your responsibilities as a policyholder.

Key aspects to focus on include the policy period (start and end dates), the covered perils (events insured against), and any applicable deductibles (amounts you pay before coverage begins).

Exclusions are equally important, as they specify what is not covered by your policy. Carefully review these sections to avoid surprises in the event of a claim.

Pay close attention to the claims process outlined in the terms and conditions. This section details the steps you need to take to file a claim and the supporting documentation required.

If anything is unclear, don’t hesitate to contact your insurance provider for clarification. They are there to help you understand your policy and answer any questions you may have.

Factors That Affect Your Premiums

Several factors influence the cost of your insurance premiums. Your age is a significant factor, with younger drivers often paying more due to higher risk. Driving history plays a crucial role; accidents and traffic violations will generally lead to increased premiums. Location matters, as areas with higher crime rates or more accidents tend to have higher insurance costs.

The type of vehicle you insure is another key determinant. Expensive cars or those with a history of theft or accidents usually command higher premiums. Your credit score can also affect your rates, as insurers often use it to assess risk. Finally, the amount of coverage you choose significantly impacts your premium; higher coverage levels typically mean higher premiums.

Your driving habits, such as mileage driven and commuting distance, can also influence premium calculations. Insurers might offer discounts for safe driving practices, such as using telematics devices. It’s important to note that these factors can vary depending on the insurer and the specific policy.

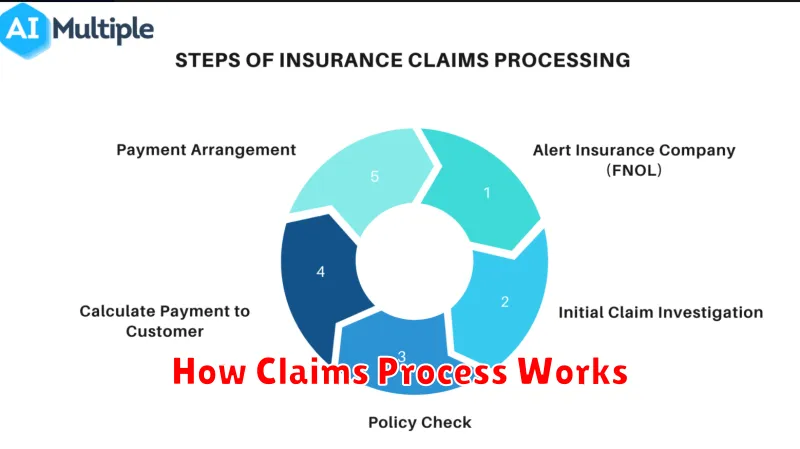

How Claims Process Works

The claims process is the method by which you report an incident covered by your insurance policy and receive compensation. It typically begins with reporting the incident to your insurance company, often within a specified timeframe.

Next, you’ll need to gather necessary documentation, such as police reports (if applicable), medical records, repair estimates, and photographs of the damage. The specific documents required will vary depending on the type of claim.

Your insurance company will then investigate the claim, which may involve reviewing your documentation, contacting witnesses, or conducting an independent assessment. This investigation helps determine liability and the extent of the damage.

Once the investigation is complete, the insurance company will determine the amount of coverage and make a decision about your claim. They may offer a settlement, which you can accept or reject. If you reject the settlement, you may have the option to negotiate or pursue other avenues.

Finally, if your claim is approved, you will receive payment for the covered expenses. This payment may be directly deposited into your account or issued as a check. The entire process can take several weeks or even months depending on the complexity of the claim and the insurer’s workload.

Common Insurance Mistakes to Avoid

One common mistake is underinsuring your assets. Failing to accurately assess the replacement cost of your home or the value of your belongings can leave you significantly underprotected in case of loss.

Another frequent error is skipping optional coverage. While seemingly expensive, add-ons like flood insurance or umbrella liability policies can offer crucial protection against unforeseen circumstances and potentially substantial financial burdens.

Failing to review your policies regularly is a critical oversight. Your needs and circumstances change, so annually reviewing your coverage ensures it remains adequate and aligns with your current lifestyle and assets. This also allows you to shop for better rates.

Many people make the mistake of not understanding their policy’s exclusions. Carefully reading and understanding what your insurance *doesn’t* cover is as important as knowing what it *does* cover, preventing unpleasant surprises during a claim.

Finally, delaying filing a claim can negatively impact your payout or even invalidate your coverage. Report incidents promptly to your insurer to initiate the claims process efficiently.

Future of the Insurance Industry

The insurance industry is undergoing a significant transformation driven by technological advancements and evolving consumer expectations. Insurtech, the intersection of insurance and technology, is revolutionizing how insurance products are designed, distributed, and serviced.

Artificial intelligence (AI) and machine learning (ML) are playing crucial roles in improving risk assessment, fraud detection, and customer service. AI-powered chatbots provide instant support, while ML algorithms analyze vast datasets to personalize premiums and offers. This leads to greater efficiency and more accurate risk profiling.

Data analytics is becoming increasingly vital for understanding customer needs and predicting future risks. Insurance companies are leveraging big data to tailor policies to specific demographics and behaviors, offering more relevant and competitive products.

The rise of the sharing economy and the Internet of Things (IoT) is impacting the industry as well. Connected devices provide insurers with real-time data on usage and risk, enabling usage-based insurance models and more accurate risk assessments. This leads to potentially lower premiums for responsible consumers.

In summary, the future of insurance promises to be more personalized, efficient, and customer-centric. The adoption of new technologies will continue to reshape the industry, driving innovation and competition.