Choosing the right personal loan can be daunting, but understanding your financial needs is the first step towards securing the best interest rates and loan terms. This guide will equip you with the knowledge to compare loan offers, navigate APR (Annual Percentage Rate) calculations, and ultimately select a personal loan that aligns perfectly with your budget and financial goals. Learn how to leverage your credit score, explore different loan types, and avoid common pitfalls to find the most suitable personal loan for your specific situation.

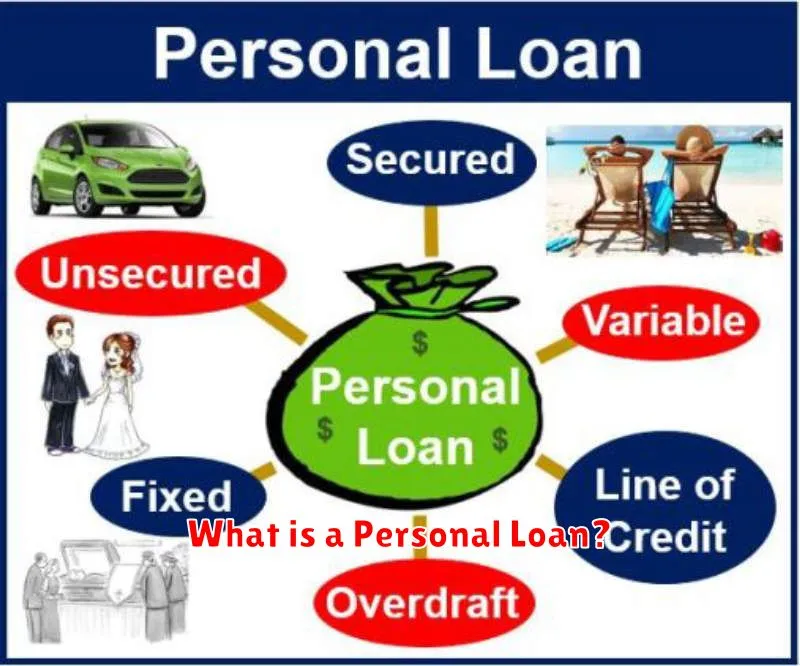

What is a Personal Loan?

A personal loan is an unsecured loan from a bank or credit union that you can use for various purposes. Unlike secured loans, such as mortgages or auto loans, personal loans don’t require collateral. This means the lender doesn’t have a claim on your assets if you fail to repay the loan. The loan amount is typically disbursed as a lump sum, and you repay it in fixed monthly installments over a predetermined period, with interest.

Interest rates on personal loans vary depending on your credit score, income, and the loan amount. Loan terms (the repayment period) also influence the overall cost of the loan. Shorter loan terms mean higher monthly payments but less interest paid overall, while longer terms result in lower monthly payments but higher total interest.

Personal loans are often used for debt consolidation, home improvements, major purchases, or unexpected expenses. They offer a flexible and convenient way to borrow money for various needs, provided you meet the lender’s eligibility criteria.

Types of Personal Loans

Understanding the various types of personal loans is crucial for selecting the best option for your financial needs. Personal loans are broadly categorized based on their purpose, repayment terms, and the lending institution.

Secured Personal Loans: These loans require collateral, such as a car or savings account. If you default, the lender can seize the collateral. They often come with lower interest rates due to the reduced risk for the lender.

Unsecured Personal Loans: These loans don’t require collateral. Approval depends on your creditworthiness. Interest rates are generally higher than secured loans because of the increased risk to the lender.

Debt Consolidation Loans: These loans help consolidate multiple debts into a single monthly payment. This can simplify budgeting and potentially lower your overall interest payments, depending on the interest rate of the new loan.

Home Equity Loans: Using your home’s equity as collateral, these loans offer larger amounts but carry significant risk. Defaulting can lead to foreclosure.

Payday Loans: These are short-term, high-interest loans designed to be repaid on your next payday. They should be avoided whenever possible due to their extremely high interest rates and potential for creating a debt trap.

Peer-to-Peer (P2P) Loans: These loans are facilitated by online platforms that connect borrowers with individual lenders. Interest rates can vary depending on the borrower’s creditworthiness.

Choosing the right type of personal loan depends on your credit score, financial situation, and the intended use of the funds. Careful consideration of these factors is essential before applying for a personal loan.

How to Compare Loan Offers

Comparing personal loan offers effectively involves a systematic approach. Start by focusing on the Annual Percentage Rate (APR), which reflects the total cost of borrowing, including interest and fees. A lower APR is always preferable.

Next, examine the loan term. Shorter loan terms typically mean higher monthly payments but less interest paid overall. Conversely, longer terms result in lower monthly payments but higher total interest. Carefully weigh these factors based on your budget and financial goals.

Don’t overlook fees. Some lenders charge origination fees, prepayment penalties, or other charges. Factor these into your overall cost calculation to get a true picture of the loan’s expense.

Consider the loan amount offered versus your actual needs. Avoid borrowing more than necessary to minimize your debt burden.

Finally, assess the repayment terms and ensure they align with your financial capabilities. Review the loan agreement thoroughly before accepting any offer.

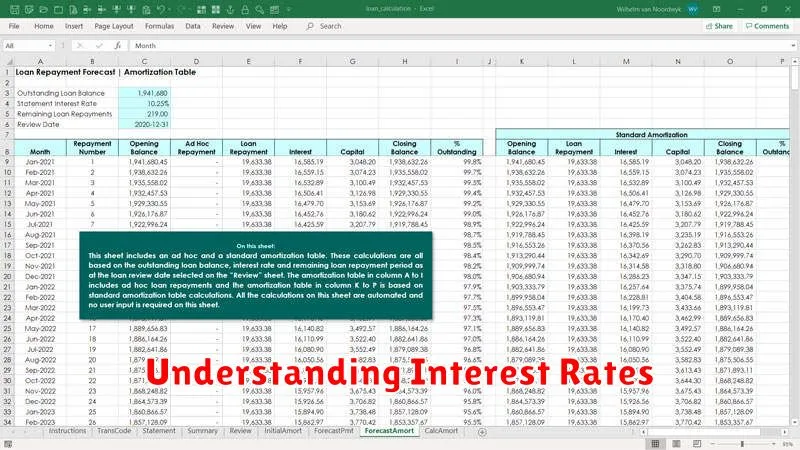

Understanding Interest Rates

Understanding interest rates is crucial when choosing a personal loan. The interest rate is the cost of borrowing money, expressed as a percentage of the loan amount. A lower interest rate means you’ll pay less overall.

Fixed interest rates remain the same throughout the loan term, providing predictable monthly payments. Variable interest rates fluctuate based on market conditions, potentially leading to higher or lower payments over time. Consider your risk tolerance when choosing between these options.

The Annual Percentage Rate (APR) represents the total cost of the loan, including interest and other fees. It’s a vital figure to compare across different loan offers. A lower APR generally indicates a better deal.

Interest rate calculations vary depending on the loan type and lender. Some lenders use simple interest, while others use compound interest. Carefully review the loan terms to understand how your interest will be calculated.

Before committing to a personal loan, shop around and compare interest rates from multiple lenders. Your credit score significantly influences the interest rate you qualify for. Improving your credit score can lead to more favorable terms.

Credit Score and Loan Eligibility

Your credit score is a crucial factor determining your eligibility for a personal loan and the terms you’ll receive. Lenders use it to assess your creditworthiness – essentially, your ability to repay borrowed money.

A higher credit score (generally above 700) typically translates to better loan offers, including lower interest rates and potentially higher loan amounts. This is because lenders perceive you as a lower risk.

Conversely, a lower credit score might make it harder to qualify for a loan or result in less favorable terms, such as higher interest rates and fees. Some lenders may even reject your application altogether.

Before applying for a personal loan, it’s wise to check your credit report for accuracy and identify any areas for improvement. Improving your credit score before applying can significantly increase your chances of securing a favorable loan.

Consider exploring options for bad credit loans if your score is low, but be prepared for higher interest rates and stricter requirements. Always compare offers from multiple lenders to find the best terms available to you.

Loan Repayment Strategies

Choosing the right loan repayment strategy is crucial for successful debt management. Several options exist, each with its advantages and disadvantages.

The principal-first strategy focuses on paying down the loan’s principal balance as quickly as possible. While this might result in higher initial payments, it reduces the total interest paid over the loan’s lifetime.

Alternatively, the interest-first strategy prioritizes paying off the interest accrued first. This reduces the overall interest burden, but the principal balance might take longer to repay.

A blended repayment strategy combines elements of both principal-first and interest-first approaches, aiming for a balance between reducing the principal and minimizing interest costs. This often involves making consistent payments exceeding the minimum required amount.

Before selecting a strategy, carefully review the loan terms, including the interest rate, repayment period, and any associated fees. Consider your financial capacity and choose a plan that aligns with your budget and financial goals.

Budgeting is paramount. Create a realistic budget that incorporates your loan repayment and other essential expenses. This ensures you stay on track and avoid missed payments.

Finally, consider exploring options for extra payments when possible. Even small additional payments can significantly shorten the repayment period and reduce the total interest paid.

Common Pitfalls to Avoid

Choosing a personal loan requires careful consideration to avoid common pitfalls. Failing to compare interest rates and fees across multiple lenders is a major mistake. Different lenders offer vastly different terms, and neglecting to shop around can lead to significantly higher overall costs.

Another crucial aspect is understanding the loan terms thoroughly. Carefully review the contract, paying close attention to the repayment schedule, any prepayment penalties, and the total cost of the loan. Misunderstanding these details can lead to unexpected expenses and financial strain.

Borrowing more than necessary is another common trap. Only borrow the amount you truly need to avoid unnecessary interest charges and prolonged repayment periods. Overestimating your needs can lead to a heavier debt burden.

Finally, neglecting your credit score is a critical oversight. A strong credit score significantly improves your chances of securing a favorable interest rate. Improving your credit before applying for a loan can save you considerable money in the long run.

Tips for Faster Loan Approval

Securing a personal loan quickly hinges on several key factors. Strong credit score is paramount; aim for a score above 700 for the best chances of approval. Lenders heavily scrutinize your credit history, so maintaining a positive payment record on existing debts is crucial.

Beyond credit, stable income is essential. Provide clear documentation of your income, including pay stubs or tax returns, to demonstrate your repayment capacity. A low debt-to-income ratio (DTI) shows lenders you can manage your finances effectively. Keeping your DTI below 43% significantly improves your approval odds.

Carefully choose a loan amount you can realistically repay. Borrowing only what you need minimizes risk and demonstrates responsible financial behavior. Finally, complete the application accurately and thoroughly. Incomplete or inaccurate information can delay the process significantly.

By focusing on these key areas – credit, income, debt, and application accuracy – you can significantly increase your chances of faster loan approval.